Disney reported earnings that beat analyst expectations, driven by strong performance in its streaming unit. However, the stock was down about 1% in premarket trading. The company earned $1.39 per share on revenue of $23.16 billion, surpassing the forecasted profit of $1.19 per share on revenue of $23.07 billion. Despite the beat, investors seemed to be unimpressed. This reaction suggests that even when companies exceed expectations, it may not always translate to immediate gains in their stock price.

Airbnb’s Revenue Guidance Miss

Airbnb shares took a hit in premarket trading, dropping nearly 14% after the company provided weaker-than-expected revenue guidance for the third quarter. The forecast range of $3.67 billion to $3.73 billion fell short of analysts’ expectations of $3.84 billion. This miss in revenue guidance highlights the importance of managing investors’ expectations and the impact it can have on a company’s stock price. Investors were clearly expecting more from Airbnb, and the stock price suffered as a result.

Reddit Surpasses Expectations

In contrast to Disney and Airbnb, Reddit saw its stock rise 1% in premarket trading after posting second-quarter results that exceeded Wall Street estimates. The company reported better-than-expected daily active user metrics and provided a third-quarter revenue outlook above estimates. This positive reception from investors shows the value of consistently delivering results that surpass expectations. Reddit’s ability to outperform in both metrics and guidance helped boost investor confidence and drive the stock price higher.

Lyft shares plummeted over 13% in premarket trading due to disappointing third-quarter revenue guidance. The company’s forecasted revenue range of $90 million to $95 million was below analysts’ expectations of $103.4 million. The significant drop in the stock price underscores the negative impact of failing to meet revenue expectations. Despite potential growth in other areas, such as user base or market share, failing to deliver on revenue guidance can have a severe impact on investor sentiment and stock price performance.

CVS Health reported second-quarter earnings that surpassed expectations but lowered its full-year profit outlook due to higher medical costs. The stock slipped slightly after the announcement, highlighting the market’s mixed reaction to the company’s results. While exceeding earnings expectations is typically positive, the revised profit outlook raised concerns among investors. This reaction demonstrates how a combination of positive and negative news can lead to a neutral performance in a company’s stock price.

Novo Nordisk’s Downturn

Novo Nordisk experienced a 4% drop in its stock price after reporting weaker-than-expected second-quarter results and lowering its full-year operating profit outlook. Despite optimism surrounding its popular weight-loss drug, the company’s performance fell short of expectations, leading to a decline in its stock price. This instance serves as a reminder of the importance of consistently meeting or exceeding expectations to sustain investor confidence and drive stock price performance.

Rivian saw its stock decline by 9% after reporting a widening net loss in the second quarter. While the company beat expectations on certain metrics, such as adjusted earnings and automotive revenue, the overall net loss increase overshadowed these successes. This reaction underscores the significance of bottom-line results in influencing investor sentiment and stock price movements. Even positive operational metrics may not be enough to offset a significant increase in losses.

Amgen’s stock shed 3% after tightening its full-year earnings outlook and reporting weaker-than-expected profit for the second quarter. The company cited higher operating expenses as the primary reason for the adjustment, disappointing investors. The negative market reaction to Amgen’s results demonstrates how unexpected expenses or a downward revision in earnings outlook can have a direct impact on a company’s stock price.

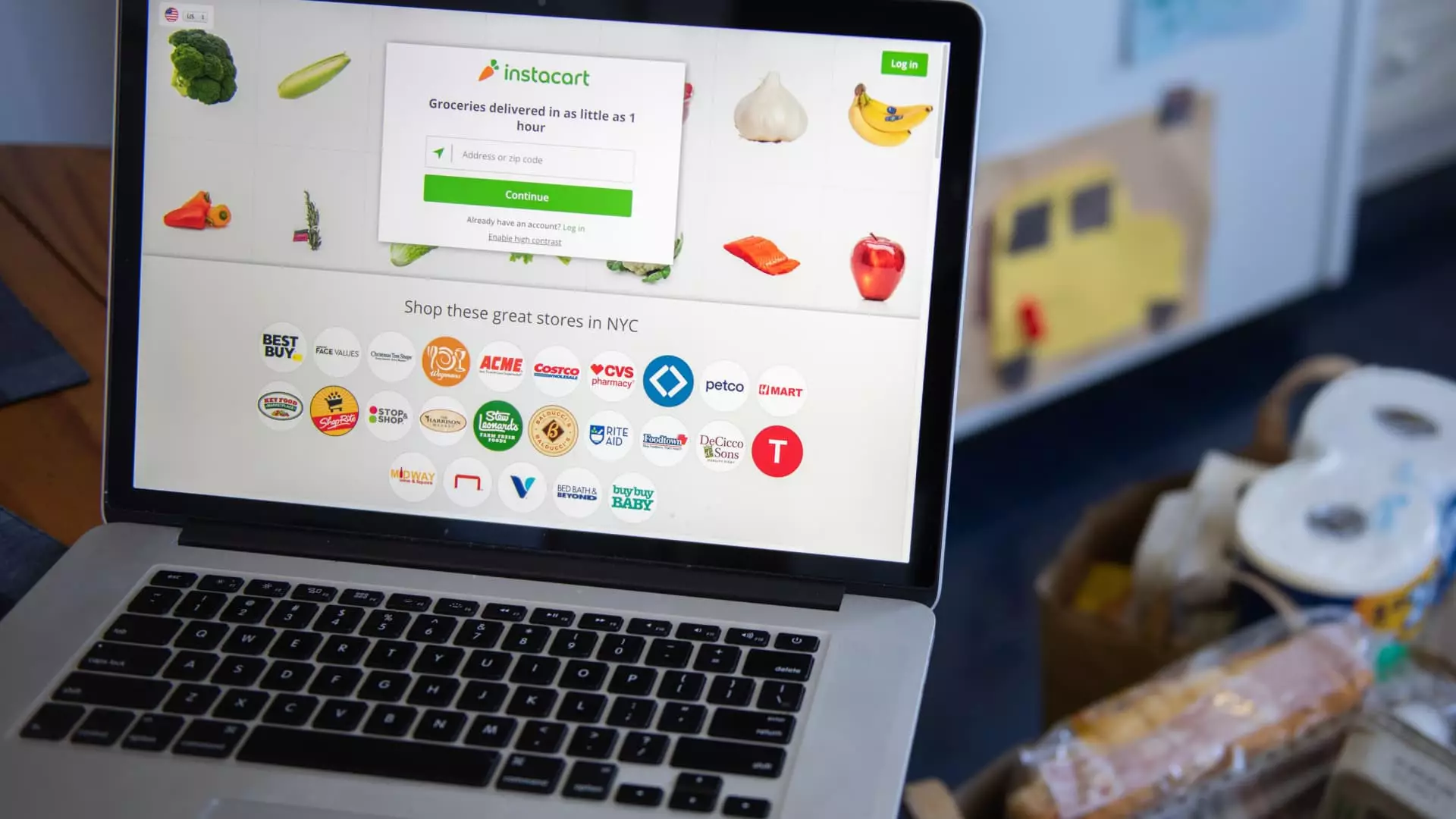

Instacart Exceeds Expectations

In contrast to companies with disappointing results, Instacart’s stock surged more than 9% after exceeding revenue and earnings estimates for the second quarter. The company’s strong performance relative to expectations boosted investor confidence and drove the stock price higher. This positive reaction emphasizes the importance of consistently delivering results that surpass analyst estimates to generate positive momentum in a company’s stock price.

Wrapping Up

The premarket movements of these companies highlight the volatility of the stock market and the importance of managing investor expectations. Companies that exceed expectations, such as Reddit and Instacart, can see significant gains in their stock price, while those that disappoint, like Airbnb and Lyft, face negative reactions from investors. It is crucial for companies to consistently deliver strong results and meet or exceed guidance to maintain investor confidence and drive positive stock price performance in the long term.