The surge of Chinese artificial intelligence stocks has been undeniable, especially in light of the recent market recovery. The unveiling of OpenAI’s Sora text-to-video product during the Lunar New Year holiday sparked a wave of excitement among locals. This excitement translated into a significant boost for AI-related stocks when the markets reopened on Feb. 19. Wind Information’s introduction of the Sora concept stock index for mainland China A shares saw a remarkable increase of over 20% in just one week. Additionally, other Wind AI-related indexes experienced similar gains in the past few days.

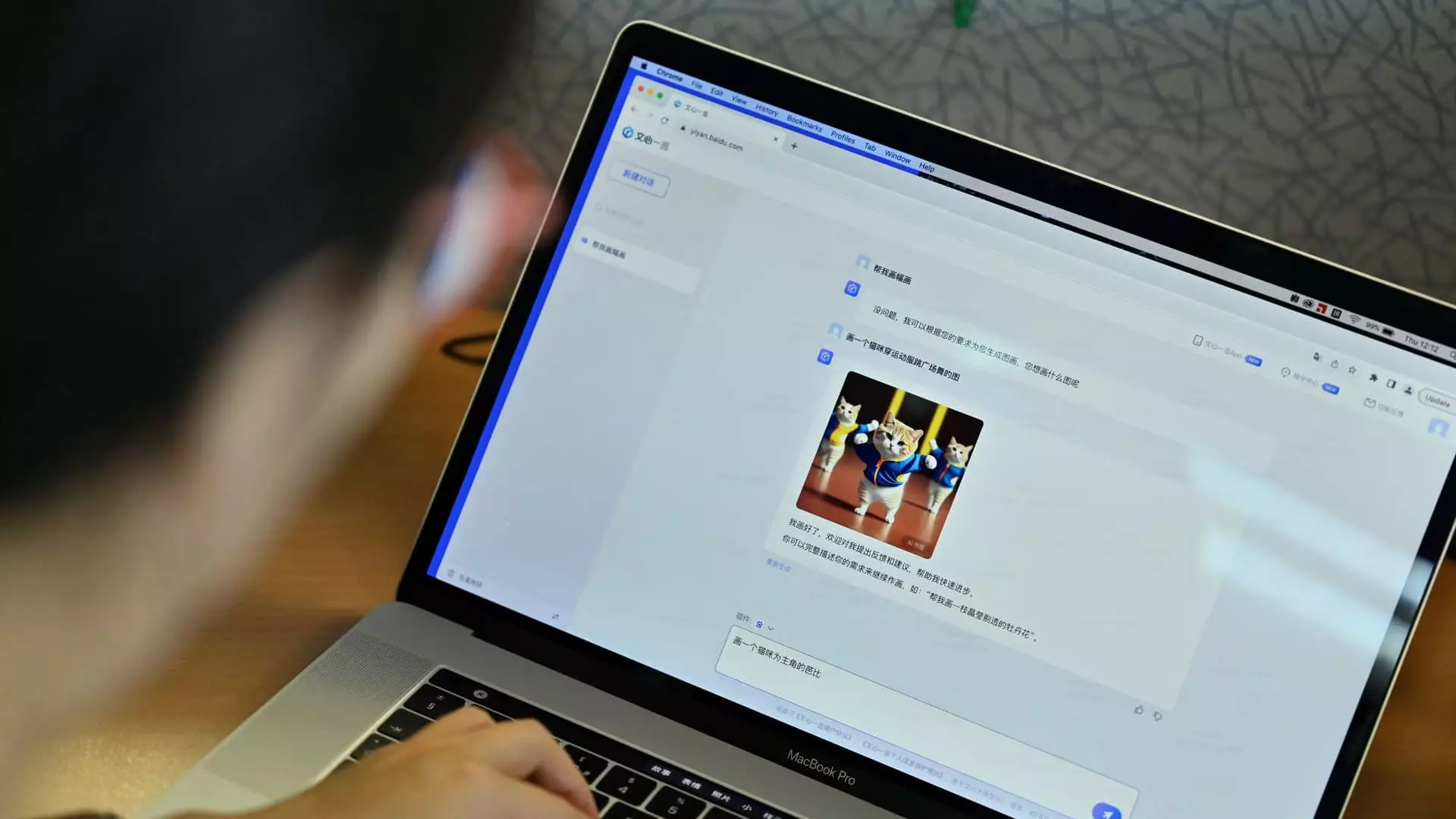

As one of the key players in the Chinese tech industry, Baidu is poised to make a significant impact on the AI landscape. According to Morgan Stanley, Baidu is considered the “best AI play in China Internet.” The integration of Baidu’s Ernie chatbot with Samsung’s Galaxy S24 smartphones and its collaboration with Honor, a smartphone brand under Huawei, are clear indicators of Baidu’s commitment to AI innovation. Furthermore, analysts have set a price target of $140 for Baidu’s U.S.-listed shares, reflecting an optimistic outlook for the company’s future growth potential.

With Baidu set to release its quarterly results for the final months of 2023, investors are eagerly anticipating the company’s performance. While the macroeconomic environment in China may pose challenges for Baidu’s core ads business, the adoption of AI tools, such as generative AI-powered ad platforms, is expected to drive revenue growth. Benchmark analysts project that generative AI ads could contribute over 100 million yuan to Baidu’s fourth-quarter results, with the potential to surpass 1 billion yuan in revenue for the year. This optimistic forecast has led to a price target of $210 per share on Baidu by Benchmark and $215 by JPMorgan China internet analyst Alex Yao.

Despite the positive momentum in Chinese AI stocks, regulatory uncertainties and market volatility remain key concerns. Recent changes in leadership within China’s securities regulator and increased scrutiny on market manipulation have added to the uncertainty in the market. However, the Shanghai Composite has managed to rebound by more than 4% in the past week, signaling a potential recovery. On the other hand, U.S. regulations surrounding China-related AI companies have also created challenges, as seen in Nvidia’s declining China revenue share and Baidu’s association with Chinese military testing.

Looking ahead, there are promising opportunities for growth in the Chinese AI market. Bernstein analysts highlight the potential for local AI chip players to dominate the high-end semiconductor market in the next few years. Companies like Cambricon and Kingsoft Office are touted as key players in the AI space, with strong growth potential. Kingsoft Office, in particular, has integrated generative AI into its software, positioning itself for future monetization opportunities. This positive outlook has prompted analysts to set price targets that reflect substantial upside potential for these companies.

The rise of Chinese artificial intelligence stocks represents a significant opportunity for investors looking to capitalize on the growing AI market in China. While regulatory challenges and market uncertainties persist, the strong performance of key players like Baidu and the emergence of innovative AI technologies bode well for the future of the industry. As Chinese AI companies continue to push the boundaries of innovation, investors can expect to see sustained growth and potential opportunities for long-term investment in this dynamic sector.