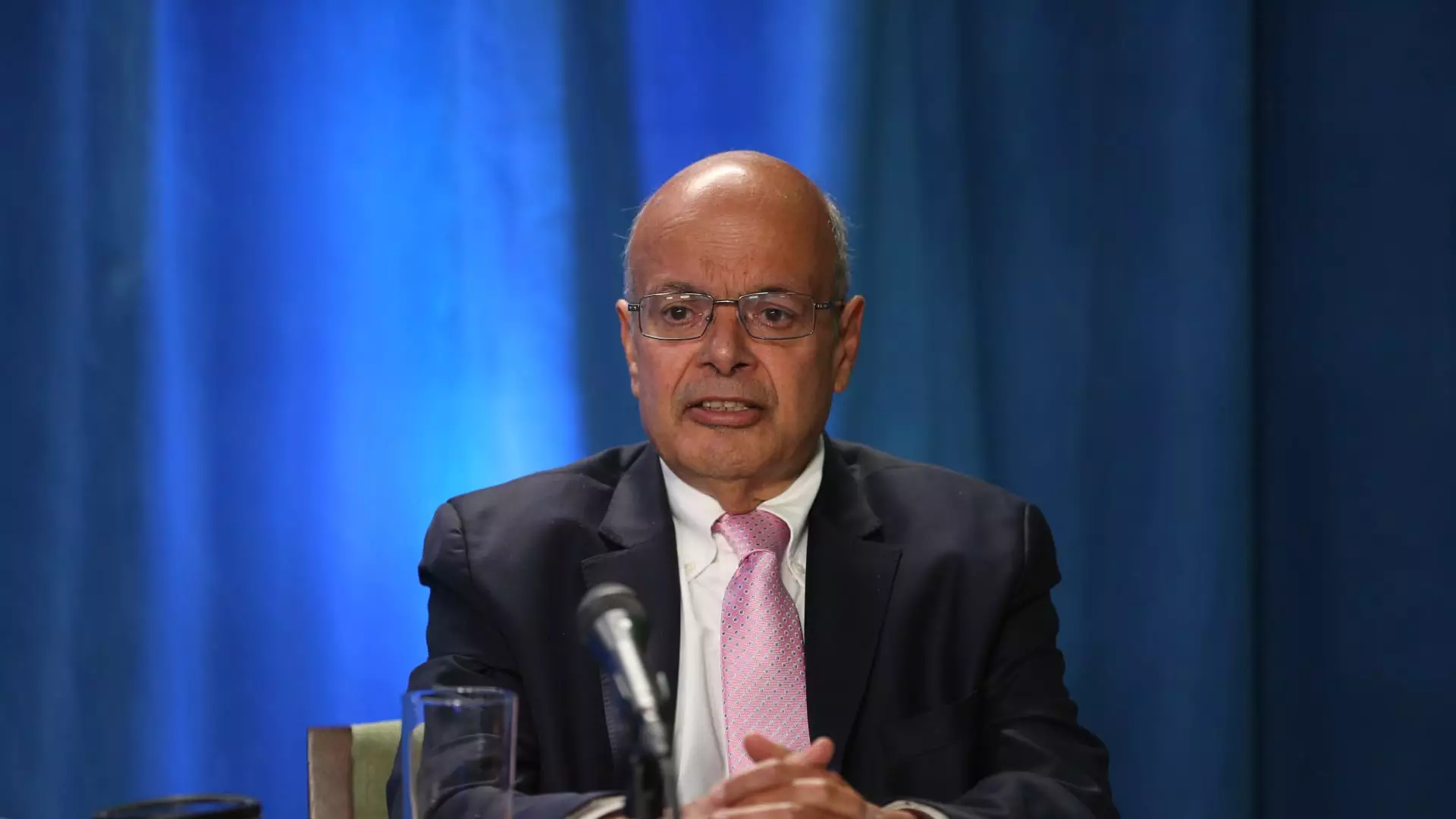

Ajit Jain’s recent decision to significantly reduce his stake in Berkshire Hathaway has stirred discussions among investors and analysts alike. As a prominent figure within the company, his actions may indicate much more than just personal financial maneuvering; they could signal changes in the broader market and Berkshire’s valuation. This article aims to dissect Jain’s decision, its potential implications for Berkshire Hathaway, and the larger landscape of the insurance and investment sectors.

Ajit Jain, who has served as Berkshire Hathaway’s Vice Chairman of Insurance Operations since 2018, sold off 200 shares of Class A stock, reaching an approximate total of $139 million at an average price of $695,418 per share. This transaction reduced his holding to a mere 61 shares, while his family trusts and the Jain Foundation maintain limited stakes as well. Such a significant sale—55% of his total shares—marks the first time since joining Berkshire in 1986 that Jain has diminished his holdings to this extent. The timing of the sale aligns with a peak in Berkshire’s stock price; the company recently surpassed a $1 trillion market capitalization, a rare feat that has led to speculation about the underlying motivation behind Jain’s actions.

While the exact reasons for Jain’s selling spree remain undisclosed, financial analysts propose several theories. The notion that Jain perceives Berkshire as “fully valued” cannot be overlooked. Many analysts have remarked that with the company’s stock trading at prices above $700,000, it may not represent a lucrative investment opportunity; rather, it may be a prudent time to cash out. David Kass, a finance professor, expressed this sentiment succinctly, suggesting that Jain’s move could reflect a broader hesitation regarding the long-term growth prospects of Berkshire stock.

A reduction in share buybacks—a strategy employed by Berkshire to enhance shareholder value—may also factor into this narrative. Recent reports indicate that the company bought back a modest $345 million worth of its own stock in the second quarter of this year, a stark deviation from the $2 billion average in previous quarters. Bill Stone from Glenview Trust Co. argues that this slowdown indicates the stock is trading close to its book value, suggesting that the stock may not be considered a bargain.

Despite the speculative interpretations surrounding his recent sale, Ajit Jain’s contributions to Berkshire Hathaway cannot be understated. Since joining in 1986, he has been instrumental in expanding the company’s footprint in the reinsurance sector and spearheading the revival of Geico, a crucial asset in Berkshire’s portfolio. Warren Buffett himself once lauded Jain’s ability to generate “tens of billions” in value for shareholders, acknowledging his crucial role in Berkshire’s success. These accolades underscore Jain’s value proposition, making his recent stock sale all the more interesting.

Furthermore, as speculation grows regarding Berkshire’s succession plans—most notably in the context of Greg Abel being groomed for future leadership—Jain’s potential ambitions are of keen interest. While some industry insiders speculated that Jain might be a contender for leadership, Buffett clarified that Jain has “never wanted to run Berkshire,” setting the narrative straight.

Jain’s decision to liquidate a substantial portion of his holdings in Berkshires serves as a vital signpost for both existing and potential investors. It paints a picture of cautious optimism intertwined with prudent financial strategy. As Berkshire Hathaway navigates market fluctuations and evaluates its valuation, Jain’s actions—coupled with the broader slowdown in company repurchases—signal critical considerations for the future.

While one must not jump to conclusions based solely on this singular event, it serves as a reminder that even the most seasoned executives are continually evaluating their positioning in a dynamic financial landscape. Observers would be well-advised to watch this space closely, especially as Berkshire continues to evolve in the face of changing market dynamics and internal leadership transitions.