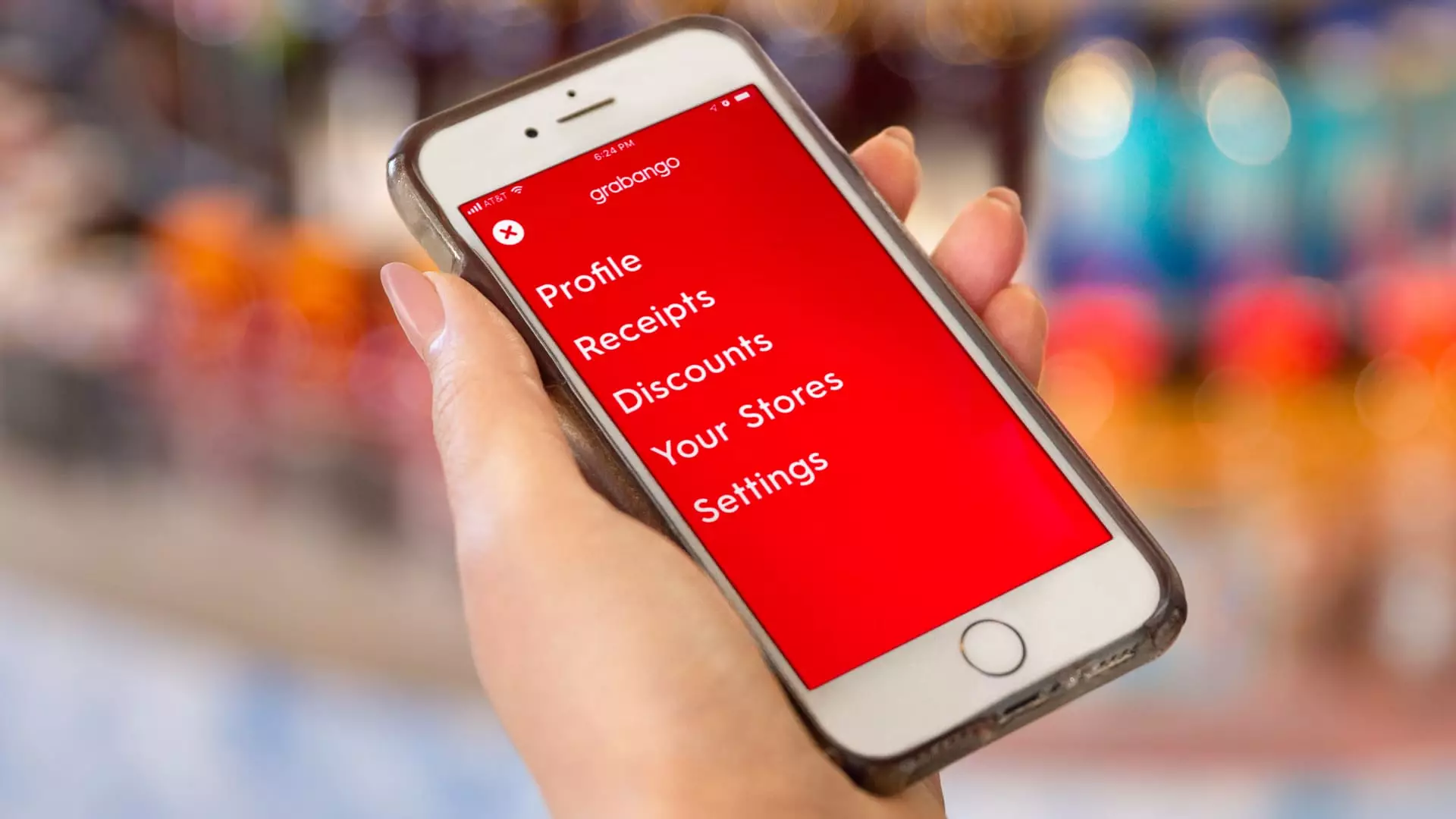

Grabango, a fledgling startup that burst onto the scene in 2016, aimed to disrupt the traditional retail landscape through its innovative checkout-free technology. Combining computer vision and machine learning, the company offered a unique solution that allowed consumers to effortlessly select items from shelves while eliminating the tedious process of going through a checkout line. With a mission to simplify shopping experiences, Grabango attracted attention from investors and partners alike, managing to raise over $73 million throughout its journey. Notably, the company forged partnerships with several grocery chains and convenience stores, positioning itself as a formidable alternative to industry giant Amazon.

The brainchild of Will Glaser, a seasoned technologist and co-founder of Pandora, Grabango’s trajectory took on a promising framework. The company not only boasted impressive technological capabilities but also garnered noteworthy financial backing, particularly from high-profile investors like Peter Thiel’s Founders Fund. Amidst hopes of an ambitious IPO that could value the firm between $10 billion and $15 billion, Glaser painted a rosy picture of Grabango’s future.

Yet, nestled within this narrative of innovation was a stark reality: the startup struggled to secure continued funding necessary for sustainability. As the venture capital landscape shifted, largely due to a deteriorating market environment, Grabango found itself at the mercy of external conditions it could not control. The once vibrant IPO market dwindled significantly since early 2022. In fact, only a handful of companies manage to go public in recent times, placing immense pressure on venture-backed startups attempting to navigate these treacherous waters.

A spokesperson’s statement underscored the unfortunate turn of events, noting that despite Grabango establishing a reputation as a pioneer in checkout-free technology, it lacked the financial resources to maintain operations. This finale of ambition serves as a vivid reminder that even the most innovative solutions can be extinguished by market dynamics and investor sentiment.

Grabango’s struggles also highlight the fierce competition present in the cashierless technology segment. Although the company carved out a niche alongside startups such as AiFi and Trigo, it frequently found itself overshadowed by Amazon’s formidable presence. The e-commerce titan’s “Just Walk Out” service, which automated the shopping experience even further, drew significant investment and consumer attention, leaving little room for rivals to thrive.

Glaser himself pointed out the vulnerabilities of Amazon’s shelf sensor-dependent system, positioning Grabango’s computer vision approach as superior in terms of scalability and performance. However, this analysis proves that a strong technological foundation does not always equate to market success, particularly when confronted with the might of a company with almost limitless resources like Amazon.

The rise and fall of Grabango evokes reflections on the current startup ecosystem and the fragility that accompanies it. When a company that positions itself as a leader in an emerging field can collapse due to funding challenges, it signals an urgent need for investors and founders to recalibrate their expectations. It underscores the importance of exploring not only groundbreaking ideas but also ensuring that financial viability is embedded in the business model from initiation.

As Grabango closes its doors, it leaves behind critical lessons for other startups. The fate of innovative ideas increasingly depends on their alignment with market realities, investors’ willingness to adapt to changing trends, and the broader economic landscape. For aspiring entrepreneurs, this serves as both a cautionary tale and a clarion call to prepare themselves for the uncertainties of the market, ensuring that they navigate the financial intricacies of startup culture with both ambition and prudence.

While Grabango’s technology was undoubtedly cutting-edge, the inability to secure robust funding emphasizes that in the highly competitive world of tech startups, innovation alone may not be enough to guarantee success.