In a recent analysis, the Federal Reserve Bank of Cleveland highlighted an ongoing economic challenge: persistent rent inflation. As the economy continues to navigate the aftermath of the COVID-19 pandemic, consumers are feeling the financial strain of increasing rental costs. The report suggests that while the broader economic indicators may show signs of recovery, the housing market remains a stubborn outlier, particularly in the context of the Consumer Price Index (CPI). Current estimates indicate that rent inflation will likely stay above pre-pandemic levels until at least mid-2026, exacerbating the financial pressures on households across the nation.

The notion of rent inflation often intertwines with the broader economic environment, and the recent Cleveland Fed report confirms that the rental market’s dynamics play a significant role in overall inflation rates. Analysts have underscored that there exists a significant disparity between new rental prices and those for existing leases. This gap is not merely a transient condition; rather, it signals a substantial adjustment delay that could prolong inflationary issues for families and individuals dependent on rental properties.

At the heart of the report is the observation of a widening gap in rental prices. As of September 2024, the Cleveland Fed estimates that the gap stands just under 5.5%, a steep increase when compared to the pre-pandemic norm, which hovered slightly above 1%. This disconnect indicates a delay in the adjustment of existing lease prices in response to the steep increases in new rental rates. Consequently, tenants with existing agreements may find themselves facing future renegotiations reflecting these inflated rates, leading to a ripple effect of financial strain.

Such dynamics are contributing to what economists describe as “sticky” inflation: a scenario where certain costs, particularly in housing, do not decrease even as other areas of the economy stabilize. This prolonged inflation in rent not only impacts individual households but also complicates the Federal Reserve’s efforts to attain its inflation target of 2%. The ability to achieve such a target hinges on various factors, but the ongoing high rental costs may hinder that objective, further complicating monetary policy efforts.

Despite these challenges, there is a glimmer of hope reflected in the projections for rent growth. According to industry analyst Omair Sharif, the annualized rent growth through September 2024 has decelerated to 4.6%, down from 6.8% earlier in the year. This deceleration is indicative of a natural cooling of the housing market, which analysts and Fed officials alike believe could lead to easing inflation overall. Experts assert that a slow but steady decline in rental prices can eventually relieve some pressure from the housing component of price indices.

Critically, the ability to forecast inflation trends is pivotal for the Federal Reserve as it adjusts interest rates. Following the insights from the Cleveland Fed, central bankers have indicated a renewed focus on rate cuts in an effort to normalize monetary policy, aiming to ease the financial burdens on consumers facing high costs of living. The relationship between housing costs and overall economic conditions is complex, and as Fed officials like Boston Fed President Susan Collins have noted, the resilience of shelter costs reflects a lingering structural issue within the rental market.

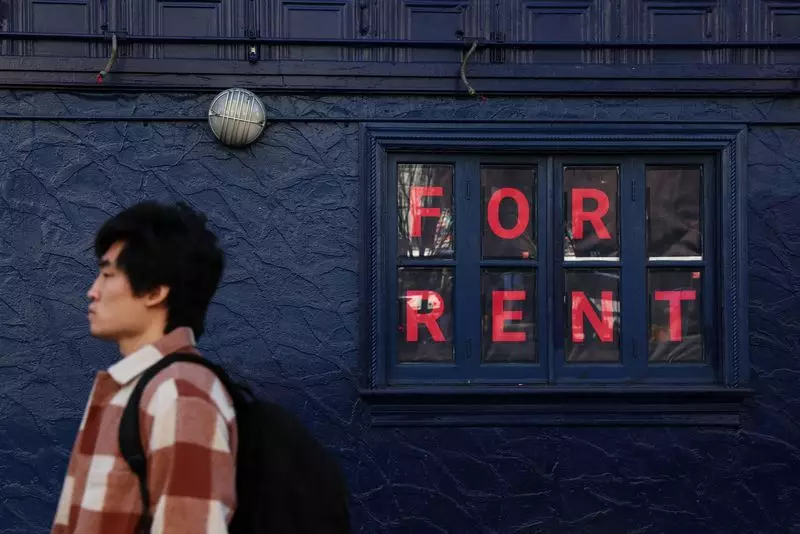

For consumers, especially those within urban areas where housing costs are skyrocketing, the implications of sustained rent inflation are profound. Many families are navigating an increasingly challenging financial landscape, where rent constitutes a significant portion of monthly expenditures. As new lease costs begin to trickle down into existing rental agreements, the likelihood of heightened financial distress among tenants escalates. This presents a critical question for policymakers: how to support renters without exacerbating inflationary pressures.

Ultimately, the challenges of rent inflation underscore a crucial aspect of economic recovery in today’s environment. While analysts project a gradual easing of inflation overall, vigilance is required in monitoring the housing sector’s trends. As households grapple with the uncertainties of the post-pandemic economy, the Federal Reserve and local governments must tread carefully, assessing both immediate needs and long-term economic strategies to ensure that consumers are not left behind in the recovery effort.