The recent announcement regarding Donald Trump Jr.’s appointment to the board of PSQ Holdings has significantly influenced the company’s stock performance, showcasing the complicated interplay between politics, business, and market sentiments. Following the news, shares in PublicSquare soared by an astonishing 270.4%, reaching $7.63. This extraordinary surge highlights the potential impact of high-profile endorsements in financial markets and raises questions about investor motivations and sentiment in the current political climate.

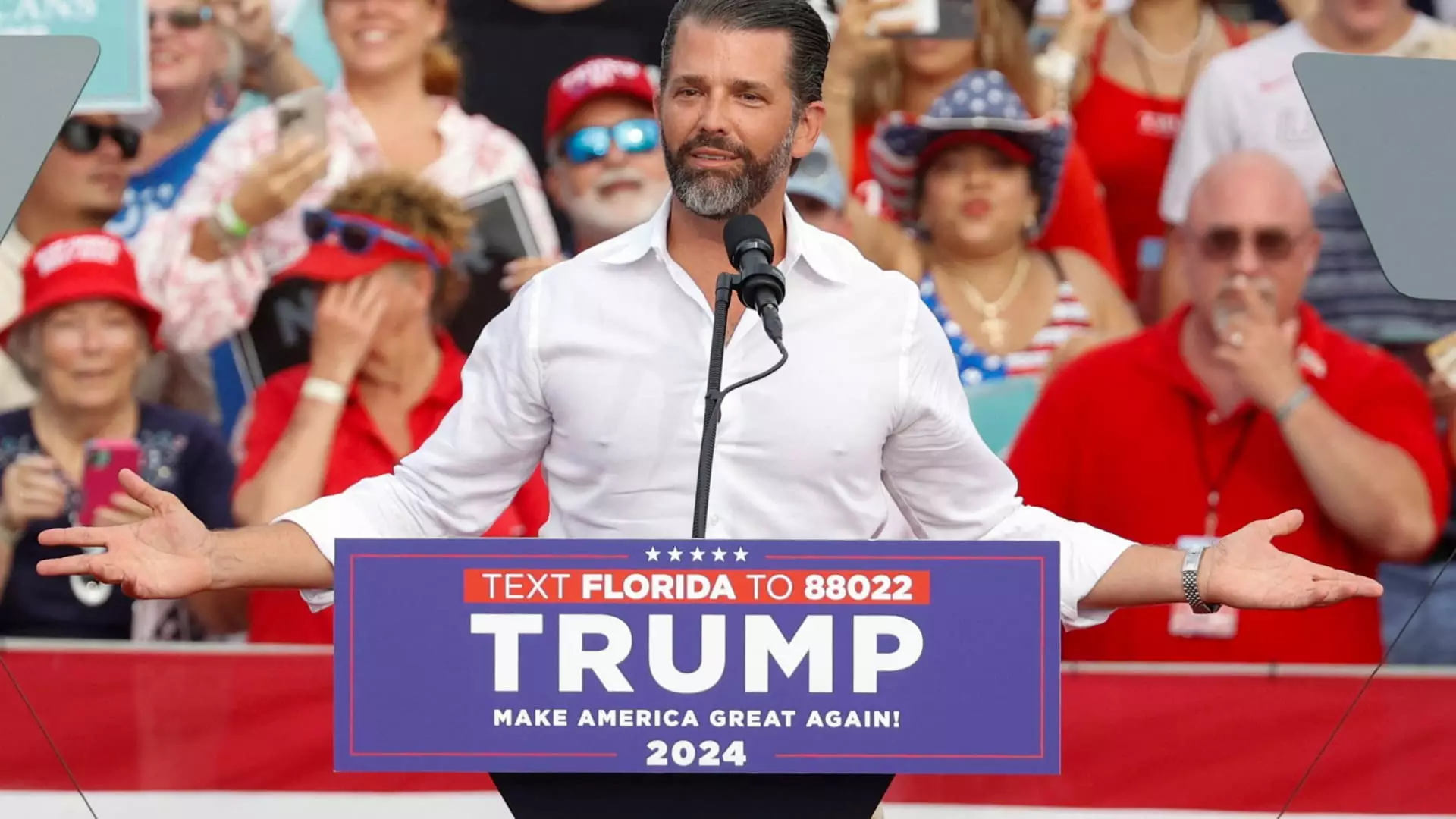

Trump Jr.’s entrance to the Board of Directors is not merely a publicity stunt; it seems to be a calculated move that aligns PSQ Holdings with the values of a significant political base that prizes “life, family, and liberty.” As a relatively young company with a market capitalization of $72 million, PublicSquare clearly benefits from associating with a figure who has substantial media presence and influence. His established interest in creating “cancel-proof” markets resonates with an increasing number of consumers looking for alternatives to mainstream platforms.

Michael Seifert, the company’s CEO, lauded Trump Jr.’s extensive background in strategic business operations and his involvement in the shooting sports industry as beneficial for the firm’s direction. Given the struggles many microcap stocks face, especially those in volatile sectors, the guidance of someone with a prominent surname could enhance credibility and attract a dedicated consumer base.

Despite the rapid rise in stock price, PSQ Holdings faces challenges that investors should not overlook. The company’s financials reveal a net revenue of $6.5 million against operating losses exceeding $14 million in the most recent quarter. Such figures hint at an uphill battle for sustainability, raising concerns about whether the current enthusiasm surrounding Trump Jr.’s board membership is based on solid ground or merely speculative excitement.

Although the market appears to celebrate the collaboration, the long-term health and viability of the business will ultimately depend on its ability to translate this initial excitement into consistent revenue growth and cost management.

The appointment comes at a time when the intersection of politics and consumer choices is increasingly in focus. Companies like PSQ are tapping into a growing demand for products and services perceived as aligned with conservative values. This trend is evidenced by other recent moves by Trump Jr., including his role in Unusual Machines and involvement with 1789 Capital, both of which are poised to cater to a demographic increasingly wary of perceived “cancel culture.”

Director Kelly Loeffler’s significant purchase of shares in PSQ just days before the stock rally underscores a strategic alignment with this budding market sentiment. Her investment, seen through the lens of recent price increases, exemplifies how strategically timed financial maneuvers can yield astounding returns.

The ascension of Donald Trump Jr. to the board of PSQ Holdings has invigorated both its stock and its public profile. However, while such appointments can significantly affect market dynamics in the short term, the lasting impact will heavily depend on how effectively the company navigates its operational challenges. Investors ought to be cautious, balancing their enthusiasm with a thorough understanding of the underlying business fundamentals that ultimately determine long-term success.