As the landscape for financial regulation undergoes unprecedented changes, the Consumer Financial Protection Bureau (CFPB) finds itself at a significant crossroads, raising vital questions about its future and functionality. Recent developments surrounding this federal agency, designed to protect consumers from predatory financial practices, suggest a turbulent period ahead, prompting discussions about both its survival and effectiveness in safeguarding the public against potential financial misconduct.

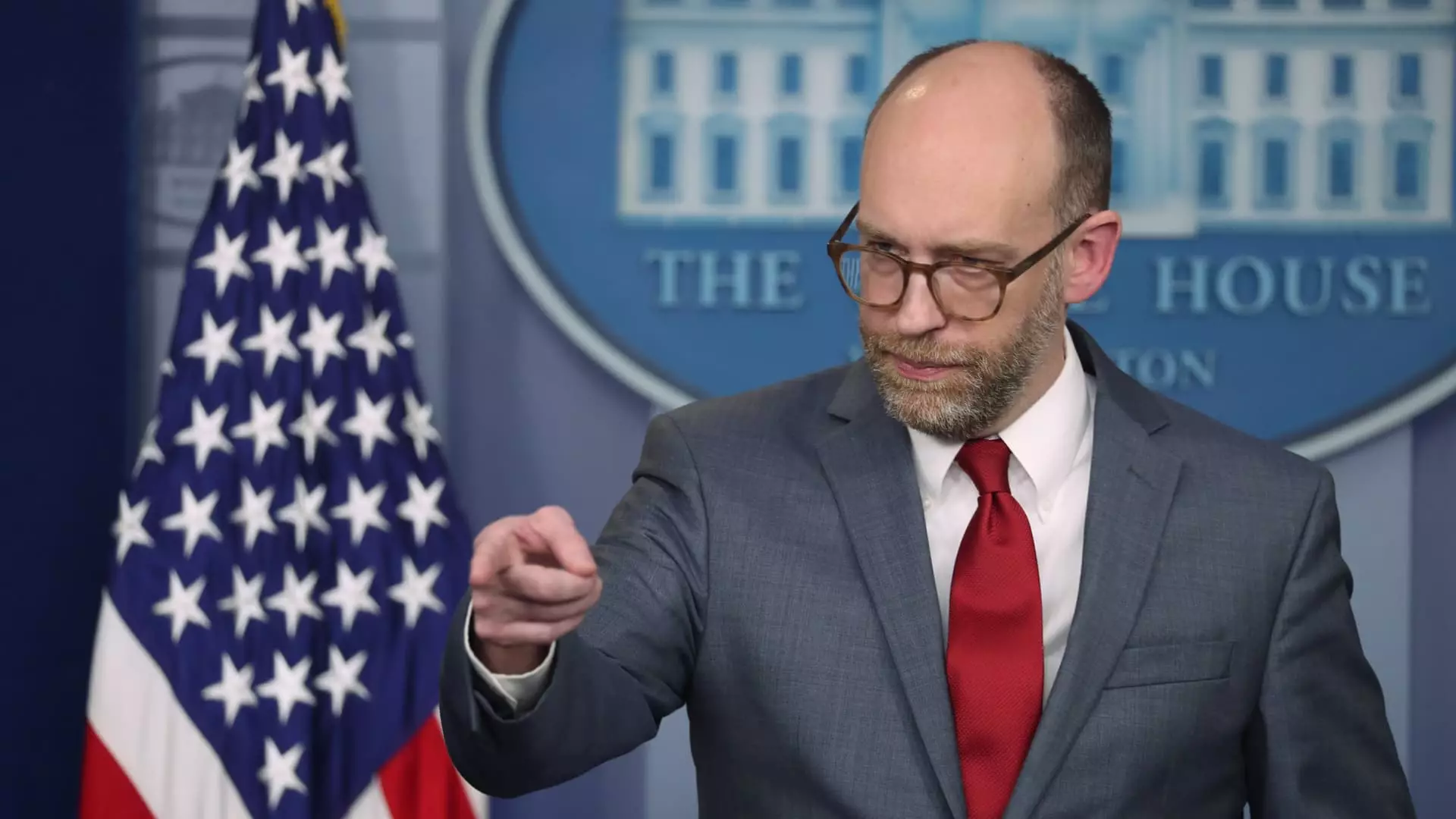

In a surprising turn of events, all CFPB employees were instructed to work remotely as their Washington, D.C. headquarters would be closed through February 14. This directive, issued by Chief Operating Officer Adam Martinez, followed a memo from the newly appointed acting director, Russell Vought, who effectively suspended most of the bureau’s activities, including crucial oversight of financial institutions. Such a significant pivot raises alarms about the continuity of the CFPB’s operations and the implications for consumer protection during an already complex economic climate.

The rapid change in operational protocols has seemingly stemmed from external pressures and high-profile interventions. Notably, employees have expressed concern regarding the involvement of personnel linked to Elon Musk’s DOGE, who reportedly gained access to sensitive CFPB data, including critical staff performance evaluations. Given the agency’s objectives, the infusion of outside and arguably disruptive influences raises important questions about organizational integrity and the protection of consumer data.

The situation is further exacerbated by Russell Vought’s controversial directives, which include halting the flow of funding to the CFPB. His statements reflect a broader objective to reshape the agency’s role within the federal structure, a plan underscored by Project 2025, a conceptual blueprint for limiting or restructuring government agencies. Vought’s actions, along with Musk’s apparent disregard for the CFPB—highlighted by his social media rhetoric calling for its termination—suggest a concerted effort to undermine consumer protections.

For the CFPB, this translates into an existential threat. Financial stability and consumer protection are often interconnected; should the agency falter, the risk of unchecked predatory practices by financial institutions could balloon. Additionally, the agency’s intentions to implement consumer-friendly regulations, such as restrictions on excessive credit card fees and measures aimed at alleviating medical debts, could be jeopardized, leading to significant financial repercussions for millions of Americans.

The present uncertainties have left many CFPB employees apprehensive about the potential for mass layoffs or administrative leaves, reminiscent of prior initiatives by Trump administration officials against various government entities. Despite having around 1,700 employees, the reality is that only a small fraction of these positions are mandated to exist by law, thus putting many individuals at risk for future job eliminations.

In light of the agency’s grave challenges, it’s vital to consider the broader ramifications of undermining the CFPB’s mandate. Established as a response to the 2008 financial crisis, the bureau was specifically intended to serve as a counterbalance to exploitative financial practices while ensuring consumer welfare. The potential disintegration of this body not only threatens its mission but could also contribute to an environment where financial institutions operate without adequate checks, risking a recurrence of historical financial injustices.

The ongoing turmoil at the CFPB raises essential questions about the efficacy of financial regulation in a post-Trump administration landscape. With a new leadership structure and considerable turbulence on the horizon, the CFPB stands at a crucial juncture. As employees navigate overwhelming uncertainty, stakeholders—including consumers, financial entities, and policymakers—must actively engage in reshaping the narrative to protect the integrity and mission of the agency.

In these challenging times, the ethos of consumer protection faces a formidable test; thus, it is imperative for all involved to advocate for the ongoing relevance and necessity of the CFPB in an increasingly precarious financial environment. Regulatory frameworks must adapt and maintain fidelity to their foundational goals: protecting consumers while ensuring a fair marketplace.