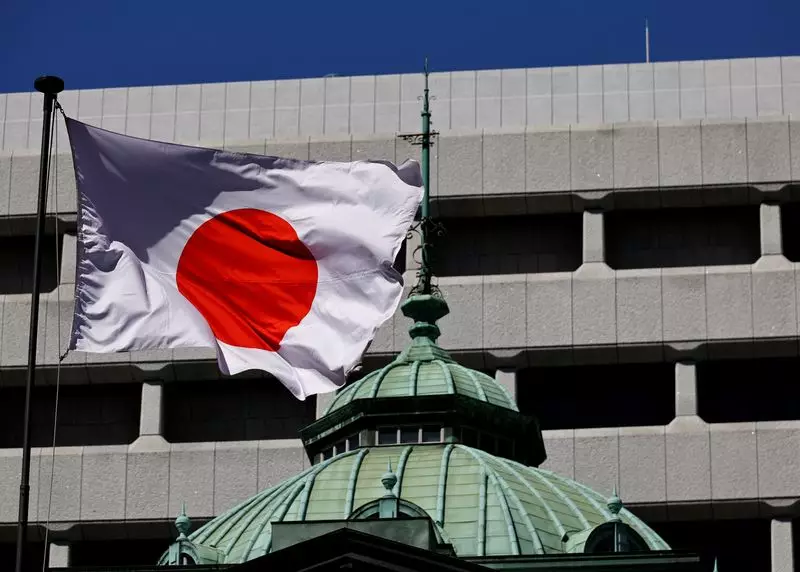

The Bank of Japan recently made a historic shift away from its unorthodox policy of negative interest rates and massive monetary stimulus that it had held for the past eight years. This move marks a significant change in the central bank’s approach to reflating growth and stimulating the economy. Let’s take a closer look at the details of this policy shift and how it will impact the various tools of the central bank’s stimulus framework.

In 2016, the Bank of Japan introduced a negative interest rate policy, which involved applying a 0.1% charge on excess reserves that financial institutions parked with the central bank. This move aimed to guide short-term borrowing costs slightly below zero and encourage banks to lend out money rather than hoard it. However, the BOJ recently decided to reverse this policy by paying 0.1% interest on excess reserves, effectively mopping up cash from the economy. As a result, the central bank will now guide the overnight call rate within a range of zero to 0.1%.

Under the yield curve control (YCC) policy implemented in 2016, the BOJ set a 0% target and a loose ceiling of 1% for the 10-year government bond yield. This policy aimed to prevent excessive falls in bond yields that flatten the yield curve and impact investors’ margins. The central bank dismantled the YCC by removing the target and reference, but it inserted guidance in the policy statement to continue purchasing bonds at a similar rate as before. Analysts anticipate that the BOJ may slow down bond buying in the future and refrain from reinvesting bond proceeds to reduce the size of its balance sheet.

The Bank of Japan began buying risky assets like exchange-traded funds (ETFs) and real estate trust funds (REITs) in 2010 to stimulate the economy. However, the central bank has decided to discontinue these purchases except in times of significant market turmoil. While the BOJ’s ETF buying has supported stock prices, it has also faced criticism for distorting market pricing and displacing private investors. The central bank also plans to gradually reduce purchases of corporate bonds and commercial paper over the next year.

Previously, the BOJ had committed to maintaining its stimulus program until it achieved its 2% inflation target and pledged to escalate stimulus measures if necessary. However, these commitments have been removed, and the central bank now offers guidance to keep monetary conditions accommodative for the time being. This move aims to reassure markets that the BOJ will not adopt a rate-hike path similar to that of the United States and Europe. The central bank remains cautious about raising rates again due to uncertainties surrounding inflation expectations and wage increases in Japan.

The Bank of Japan’s recent policy shift represents a significant departure from its previous strategies of negative interest rates and massive monetary stimulus. The central bank’s decision to discontinue certain tools and adjust its approach reflects its ongoing efforts to navigate the challenges of stimulating economic growth while maintaining stability in the financial markets. It will be crucial to monitor how these changes impact Japan’s economy and financial system in the coming months.