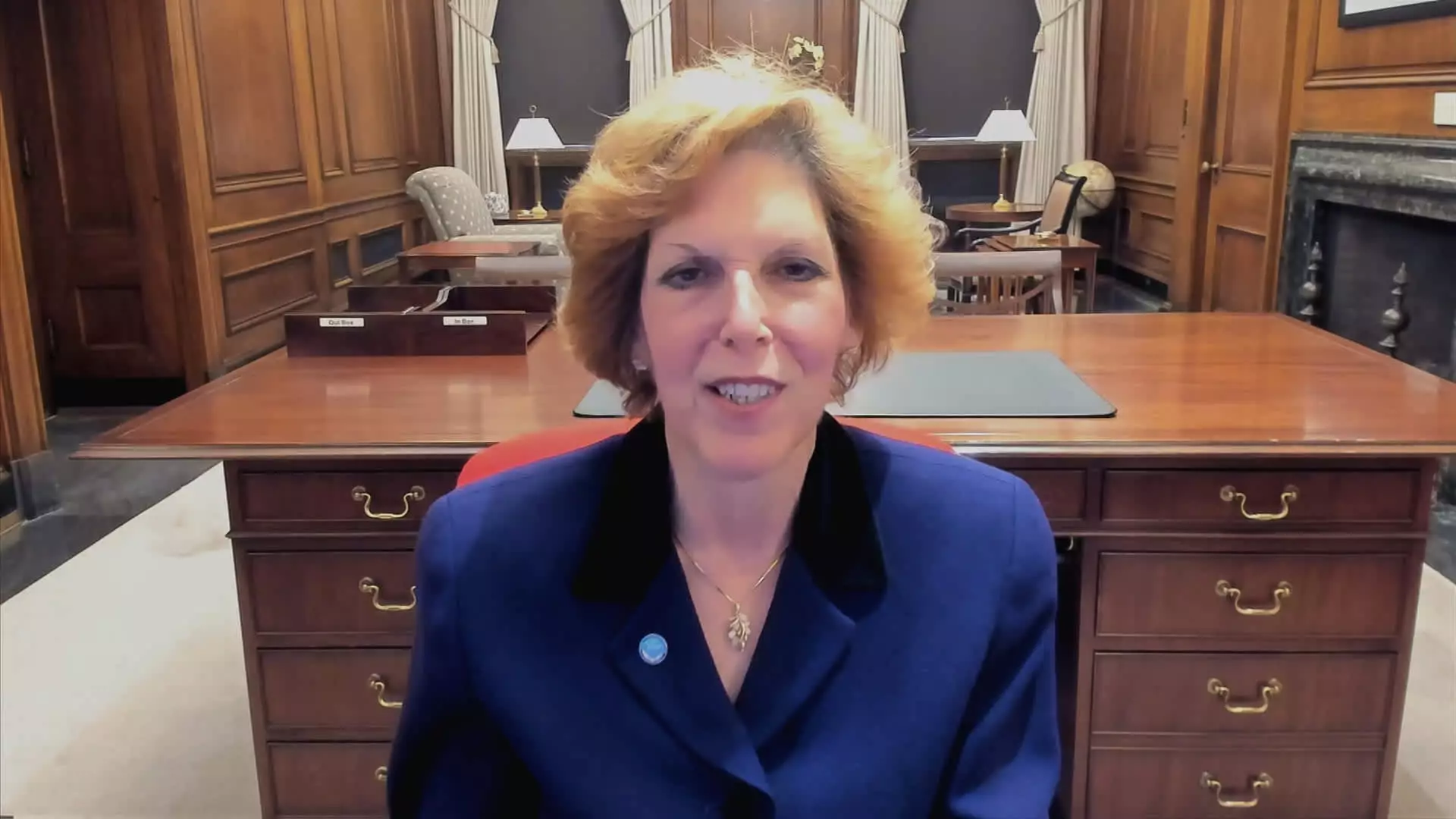

Cleveland Federal Reserve President Loretta Mester recently shared her belief that interest rate cuts will likely occur this year, although she ruled out the possibility of cuts at the next policy meeting in May. Alongside Mester, San Francisco Fed President Mary Daly also anticipates rate cuts in the coming year but emphasized the need for more substantial evidence of subdued inflation before implementing such actions. Both officials acknowledge the progress made in addressing inflation while emphasizing the importance of continued economic growth as a determining factor for potential rate adjustments.

Despite Mester’s inclination towards rate cuts, she remains cautious in her approach, demanding more data to build confidence in her projections. While she expects inflation to gradually reach the 2% target, she acknowledges the need for additional insights to support this trajectory. Daly echoes a similar sentiment, considering three rate cuts this year as a plausible scenario but highlighting the unpredictability of future economic conditions. Both officials aim to strike a balance between proactive policy measures and reactive adjustments, prioritizing economic stability in their decision-making processes.

Mester’s assertion regarding the long-run federal funds rate deviates from conventional expectations, suggesting a potential increase to 3% instead of the previously anticipated 2.5%. By reevaluating the neutral rate (r*), Mester aims to position the Federal Reserve strategically in response to evolving economic circumstances. The dynamic nature of interest rate projections underscores the challenges faced by policymakers in predicting the optimal course of action, especially in light of external factors such as the Covid pandemic.

As the Federal Reserve navigates the complexities of monetary policy, officials like Mester and Daly remain vigilant in their assessment of inflation trends and economic indicators. The gradual approach to interest rate adjustments reflects a commitment to data-driven decision-making, emphasizing the need for prudence and adaptability in an ever-changing economic landscape. While the timeline for rate cuts remains uncertain, the overarching goal of achieving sustainable economic growth remains a top priority for Federal Reserve officials.

The evolving narrative surrounding interest rate cuts signifies a balancing act between proactive stimulus measures and reactive policy adjustments. Federal Reserve officials like Loretta Mester and Mary Daly offer valuable insights into the deliberative process behind these decisions, shedding light on the complexities of economic forecasting and policy implementation. As the year progresses, it will be essential to monitor inflation trends and economic developments closely to gauge the necessity and timing of potential rate adjustments.