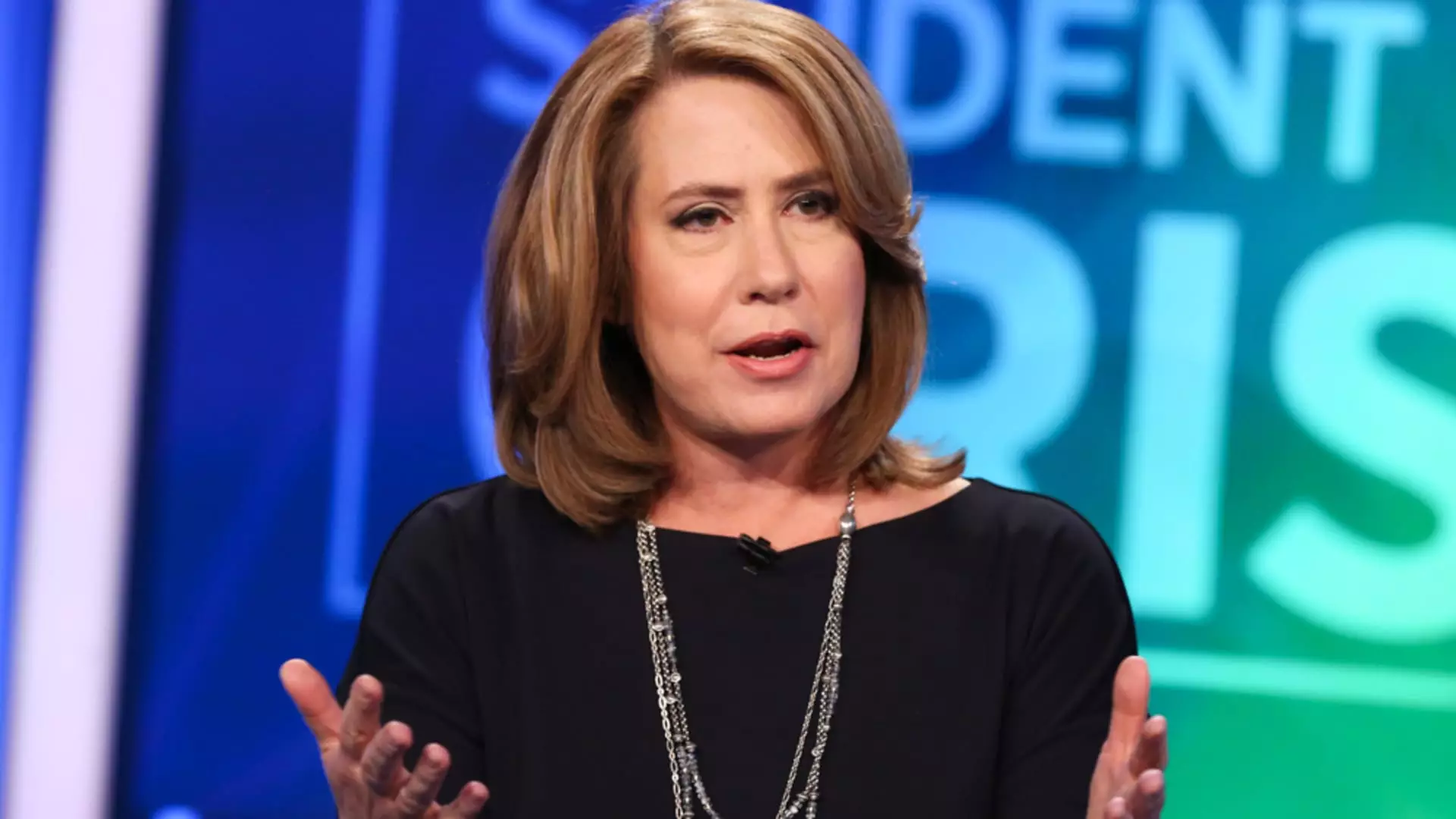

The recent earnings reports of regional banks have raised concerns about their stability and resilience in the face of economic challenges. Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp, has pointed out critical weaknesses that could potentially destabilize these banks. Her observations about the heavy reliance on industry deposits and concentrated exposure to commercial real estate highlight the vulnerabilities that regional banks are facing.

Bair’s experience during the 2008 financial crisis has made her apprehensive about the current state of regional banks. She believes that the problems they faced back in 2023 have not been fully resolved, and there is still a risk of instability, especially when it comes to uninsured deposits. The potential for another bank failure is a looming threat that regional banks must address in order to secure their financial health.

So far, regional banks have been struggling in the market. The SPDR S&P Regional Bank ETF has seen a significant decline, with only a few members maintaining positive growth in 2024. This downward trend is exemplified by the sharp drop in the stock prices of banks like New York Community Bancorp, Metropolitan Bank Holding Corp, Kearny Financial, Columbia Banking System, and Valley National Bancorp. The challenges faced by regional banks have put them at risk of further losses and financial instability.

The recent increase in the benchmark 10-year Treasury note yield has added to the concerns surrounding regional banks. Bair is worried that higher yields could place additional stress on commercial real estate borrowers, as many regional banks have significant exposure to this sector. The impending refinancing of commercial real estate loans combined with rising interest rates could lead to a surge in borrower distress and payment defaults, further complicating the situation for regional banks.

Despite the challenges faced by regional banks, there is a silver lining for larger financial institutions. Bair predicts that the distress experienced by regional banks could potentially benefit big money center banks. As regional banks struggle to maintain stability and profitability, larger institutions are poised to capitalize on their weaknesses and attract more business. This shift in market dynamics highlights the interconnectedness of the banking sector and the ripple effects of regional bank vulnerabilities on the wider financial landscape.

The challenges facing regional banks underscore the need for proactive measures to address their vulnerabilities and ensure long-term stability. By heeding Bair’s warning and taking steps to strengthen their financial resilience, regional banks can navigate the turbulent market conditions and emerge stronger in the face of economic uncertainties.