Goldman Sachs analysts are in the process of recalibrating projections for the Indian pharmaceutical sector during the ongoing Q4 FY24 earnings season. Their analysis takes into account a variety of factors, such as monthly sales data and currency fluctuations, to provide a comprehensive outlook for the sector. Notably, major players like Sun Pharma, Cipla, and Divi’s Laboratories are contributing to the sector’s positive performance, with valuations currently exceeding historical averages.

1. **Domestic Market Dynamics:** Despite modest growth in base volume, stable pricing and patent expirations are driving momentum for new products. Management’s guidance on volume growth sustainability and pricing adjustments in the National List of Essential Medicines (NLEM) portfolio is crucial.

2. **US Generic Pricing:** Concerns about base-business erosion are diminishing, with Goldman Sachs highlighting the transitory nature of current pricing trends. Price erosions are expected to stabilize at mid-to-high single digits, benefiting companies like Aurobindo and Gland.

3. **Margin Outlook:** While robust gross margins are anticipated to continue, potential headwinds from input cost escalations may impact profitability. Management commentary on cost dynamics in a volatile commodity price environment will be closely monitored.

Goldman Sachs remains bullish on select stocks, including Syngene, Neuland, Torrent Pharma, Aurobindo, Gland, and Biocon. Conversely, reservations are expressed for Laurus, Cipla, and Sun Pharma, with downward revisions to earnings projections for these companies. The analysts have made specific adjustments to target prices and identified top picks based on structural exposure and tactical plays in the US generics market.

Investors can follow a framework to make informed investment decisions, starting with tracking upgrades from prominent institutions like Morgan Stanley and Goldman Sachs. Assessing the fair value of a stock using tools like InvestingPro can help gauge potential upside. Choosing 2-3 stocks with the highest potential for a portfolio can optimize returns based on expert analysis and financial models.

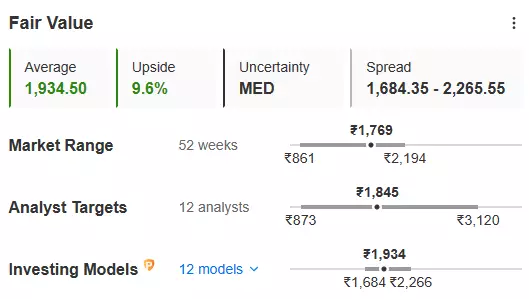

For example, Gland Pharma has received a buy rating from Goldman Sachs with a target price of INR 2,000. By using InvestingPro, investors can access real-time financial models and valuations. In this case, the fair value for Gland Pharma is INR 1,934.5, indicating a 9.6% upside potential. Aligning analyst recommendations with objective data from InvestingPro can help identify strong candidates for investment portfolios.

InvestingPro offers a limited-time discount of up to 69%, providing exclusive access to realistic stock valuations and investment insights for just INR 216 per month. Don’t miss out on this opportunity to enhance your investment strategy and maximize returns in the dynamic Indian pharmaceutical sector.