Asian stock markets showed mixed results on Thursday as they tracked the record highs set on Wall Street the night before. Despite the positive sentiment, the Japanese economy faced challenges as it shrank and the Biden administration increased trade tariffs against Beijing. The weak data from Japan raised doubts about the ability of the Bank of Japan to tighten policy this year, signaling potential headwinds for the stock market.

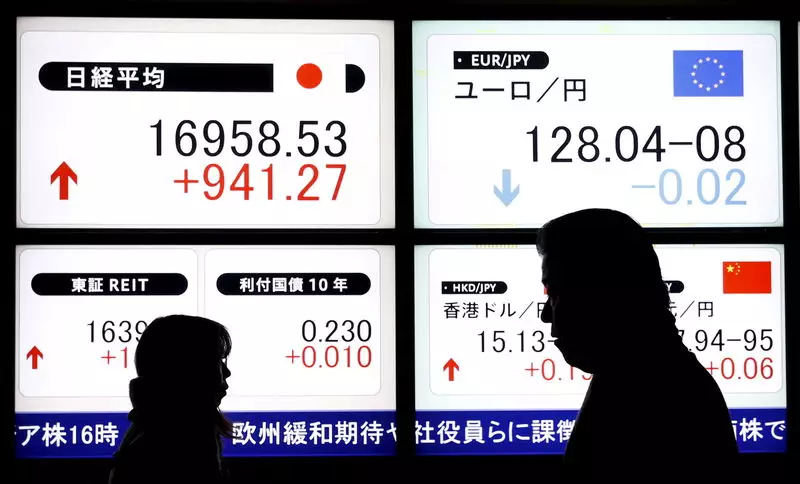

Japan’s Nikkei 225 index saw a 0.6% rise, driven primarily by the technology sector mirroring gains in the U.S. market. However, other economically-sensitive sectors experienced declines, leading to a slowdown in Japan’s broader TOPIX index. The contraction of Japan’s economy in the first quarter of 2024 was more severe than expected due to persistent inflation and sluggish wage growth, resulting in a sharp decline in private consumption. The uncertain economic outlook also caused a significant drop in capital expenditures, impacting overall economic growth.

China Faces Trade Tariffs and Economic Uncertainty

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes lagged behind their regional counterparts, showing only a 0.3% increase. The Biden administration’s decision to impose higher trade tariffs on key Chinese sectors such as electric vehicles, medicine, and solar energy added to the economic uncertainty. The potential retaliation from Beijing and the looming threat of a renewed trade war between the two economic giants cast a shadow over investor sentiment in the region.

The upcoming release of industrial production and retail sales data in China added to the caution among investors, waiting for more economic cues to make informed decisions. Hong Kong’s Hang Seng index experienced a modest 0.6% growth, falling short of the gains seen in other parts of Asia. The increase in Australia’s unemployment rate, despite the unexpected rise, raised hopes of a cooling labor market and contributed to the ASX 200 rallying 1.8% to near record highs.

Tech Stocks Lead the Way in South Korea and India

South Korea’s KOSPI index surged by 0.8% on the back of gains in technology stocks. The positive performance in the technology sector was also reflected in India, as futures for India’s Nifty 50 index indicated a favorable opening. However, caution over the upcoming Indian general elections in 2024 is expected to limit the gains in the market, highlighting the impact of political uncertainty on investor confidence.

Overall, while the optimism following the record highs on Wall Street provided a boost to Asian stock markets, challenges such as economic contraction in Japan, trade tensions between the U.S. and China, and upcoming economic data releases are keeping investors cautious. The resilience of tech stocks in the region offers a ray of hope amidst the uncertainty, but the need for careful monitoring of market dynamics remains crucial in navigating the volatile landscape of Asian stock markets.