JP Morgan has recently upgraded Apollo Tyres (APTY) to Overweight from Neutral, citing the company’s efforts to reduce debt and pursue strategic growth. Despite facing challenges such as margin misses and environmental costs, APTY has demonstrated resilience through its strong free cash flow conversion.

While the stock price of APTY has declined in recent months due to concerns over commodity inflation and environmental costs, JP Morgan foresees potential for the company to regain momentum. Price increases and lower interest expenses are expected to bolster earnings, with a projected 13% year-on-year increase.

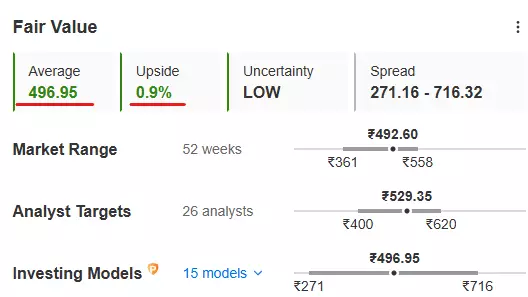

Despite the upgrade by JP Morgan, the fair value of Apollo Tyres (APLO) may not be as optimistic. After assessing complex financial models, the fair value is determined to be INR 469.95, indicating only a minor 0.9% upside from the current market price. While analyst targets vary, investors are advised to consider their positions carefully and possibly tighten stop losses to protect profits.

The 4QFY24 scorecard reveals mixed performance for APTY, with adjusted EBITDA slightly below expectations. However, improvements in ROCE and debt reduction are positive indicators. The company’s focus on pricing adjustments, capex management, and growth strategies in key markets like India and EU demonstrate a proactive approach to addressing challenges.

Investors should be aware of potential risks such as price competition in India, weak demand in the EU market, and the possibility of a large capex cycle resuming. While the price target set by JP Morgan implies positive growth prospects, it is essential for investors to conduct thorough due diligence and consider their risk tolerance before making investment decisions.

While the upgrade of Apollo Tyres by JP Morgan signifies confidence in the company’s strategic direction and financial performance, investors should approach the investment opportunity with caution. The market landscape is dynamic, and various factors can impact the stock price and overall performance of APTY. It is recommended for investors to seek professional advice and conduct their research before making any investment decisions in the current market environment.