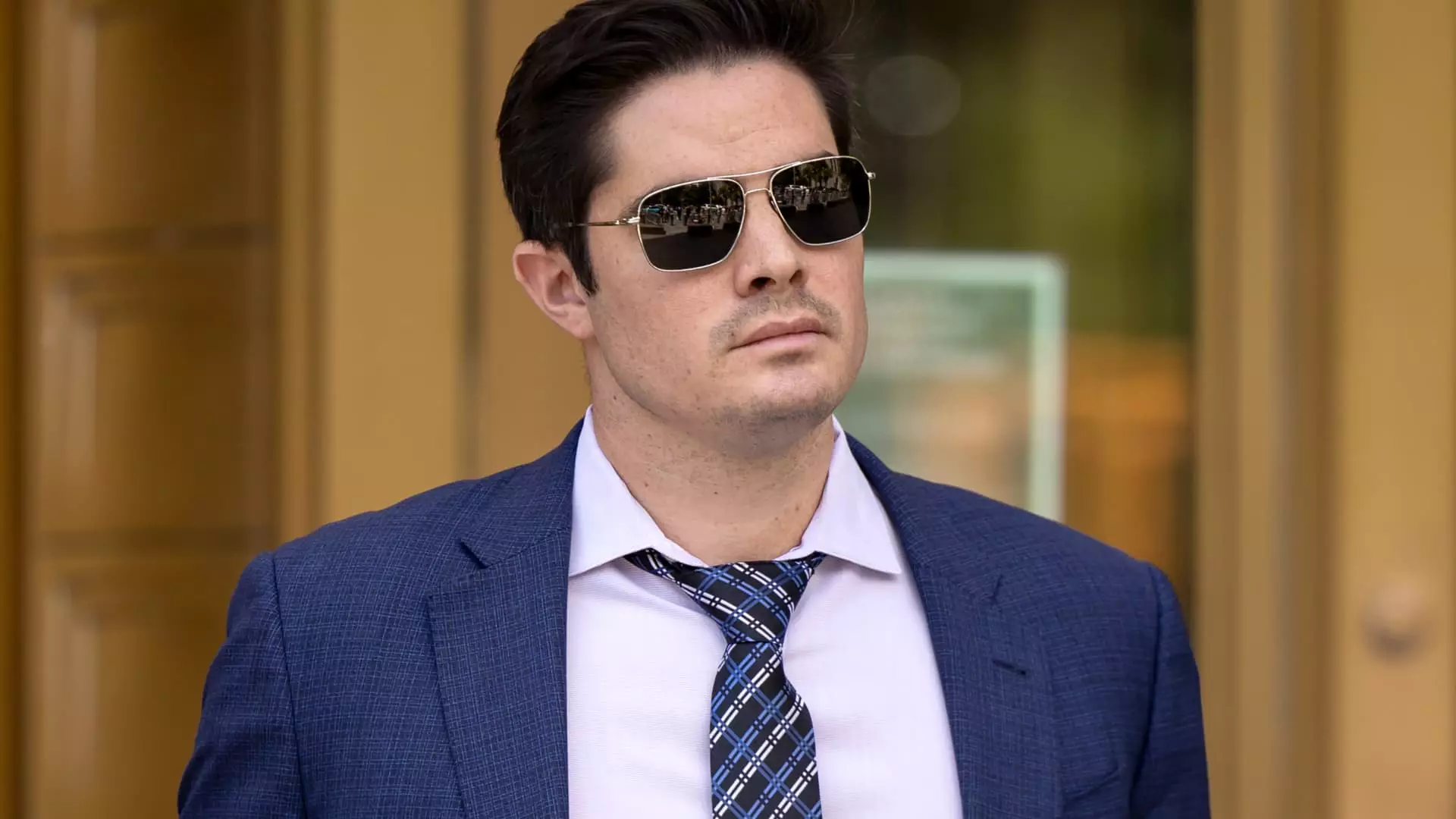

Ryan Salame, a once-promising figure in the cryptocurrency world, has now been sentenced to 90 months in prison, marking a dramatic downfall from his former high-ranking positions in the industry. Salame’s trajectory from a top lieutenant of FTX founder Sam Bankman-Fried to his eventual conviction for serious federal crimes serves as a cautionary tale of greed and betrayal.

The severity of Salame’s sentence, totaling seven and a half years in prison, followed by three years of supervised release, underscores the gravity of the crimes he committed. Moreover, the requirement to pay more than $6 million in forfeiture and over $5 million in restitution further amplifies the consequences of his actions. These penalties far exceed the initial recommendations made by prosecutors and highlight the significant impact of Salame’s illegal behaviors.

Salame’s guilty plea to charges of conspiracy to make unlawful political contributions, defraud the Federal Election Commission, and operate an unlicensed money-transmitting business revealed the extent of his illicit activities. His transition from a prominent role at Alameda Research to co-CEO of FTX’s subsidiary in the Bahamas was marked by extravagant spending on real estate and campaign donations, amounting to millions of dollars. The revelation of his involvement in funneling customer money from the crypto exchange to another firm raised serious concerns about the mishandling of assets and further eroded public trust in the financial system.

Salame’s decision to cooperate with authorities and disclose potential fraud committed by Bankman-Fried ultimately led to a cascade of testimonies from other insiders that implicated the FTX founder in criminal activities. Despite attempts by Salame’s defense team to portray his actions as cooperative and remorseful, the judge’s harsh sentence demonstrated a clear stance against the fraud and corruption that had taken place within the company. The involvement of key figures like Salame in such unlawful schemes serves as a stark reminder of the legal and ethical obligations that accompany positions of power and influence.

As Salame becomes the first of SBF’s executive team to face the consequences of their actions following the exchange’s bankruptcy, the repercussions of his crimes reverberate throughout the industry. The narrative of his downfall serves as a cautionary tale for those who may be tempted by the trappings of wealth and power, highlighting the destructive consequences of greed and deceit. The heavy penalties imposed on Salame underscore the importance of accountability and integrity in maintaining public trust and upholding the principles of ethical business practices. Ultimately, the downfall of Ryan Salame stands as a somber reminder of the fragility of reputation and the high cost of betrayal in the world of finance.