Nvidia, a major player in the chipmaking industry, has recently entered a phase of correction territory with its shares down by 10% from its most recent all-time closing high. This correction comes after a period of booming financial performance driven by the demand for its GPUs, particularly in the field of artificial intelligence.

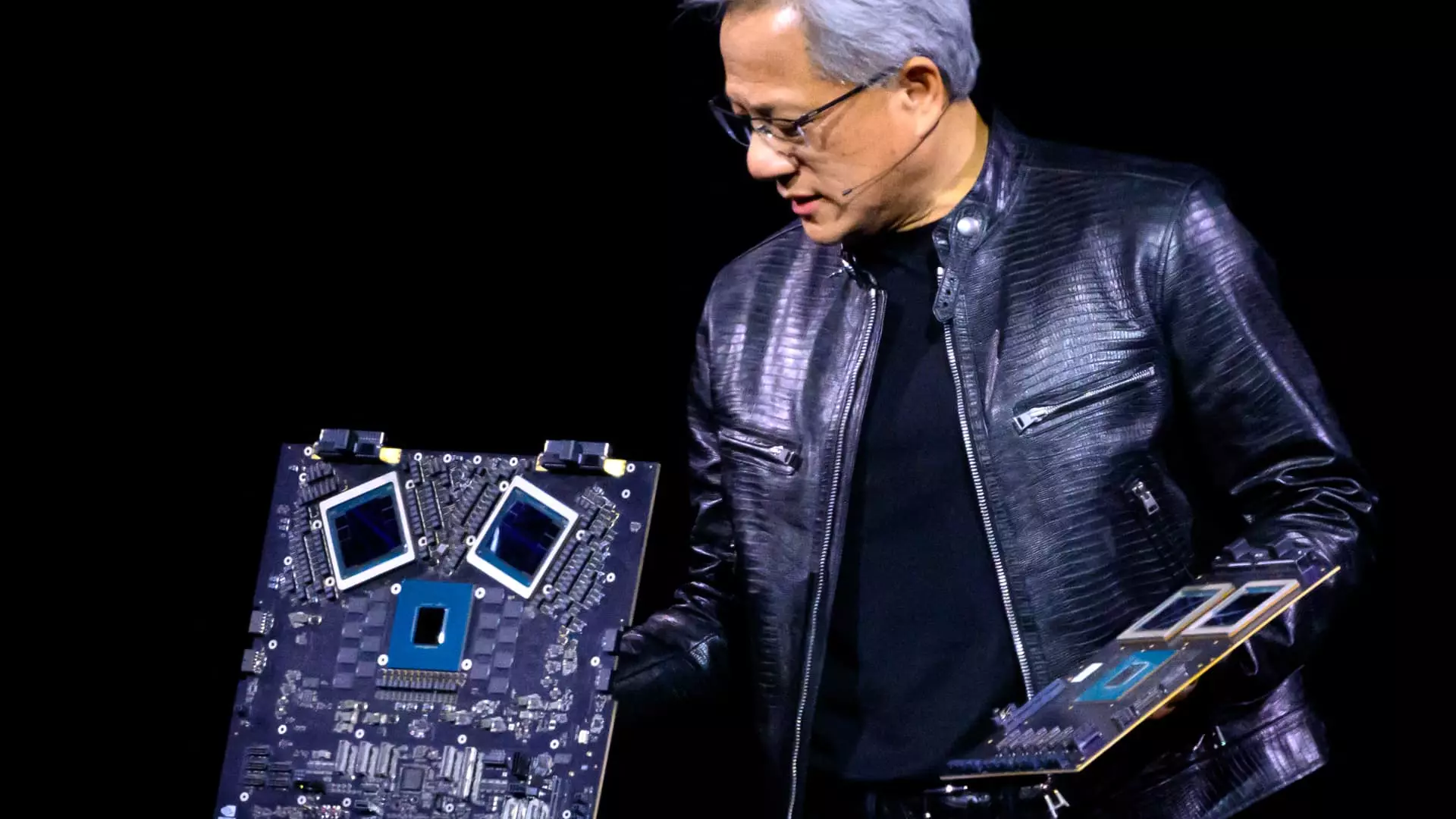

The exact reason for the downward movement in Nvidia’s share price is not immediately clear. One possible explanation could be profit-taking by investors after a significant increase in the stock price of over 200% in the last 12 months. Additionally, the unveiling of a new AI chip by rival company Intel, which boasts higher efficiency and faster performance than Nvidia’s GPUs, could also be a contributing factor.

Intel’s introduction of the Gaudi 3 AI chip poses a direct challenge to Nvidia’s dominance in the AI chip market. The Gaudi 3 chip offers superior power efficiency and speed compared to Nvidia’s H100 GPU, which is currently one of the company’s most advanced products. With the ability to power large language models effectively, Intel’s new chip could potentially eat into Nvidia’s market share in the AI segment.

Analysts at D.A. Davidson have expressed concerns about the future outlook for Nvidia, noting a potential decrease in demand for the company’s stock due to advancements in AI technology. The analysts anticipate a shift towards smaller AI models, such as Mistral’s Large model and Meta’s LLaMA system, which could lead to a decline in Nvidia’s market position. While the analysts expect Nvidia to deliver strong performance in the coming years, they foresee a significant cyclical downturn by 2026.

Overall, Nvidia’s recent share price correction, coupled with competitive pressures from Intel and changing trends in the AI industry, signal potential challenges ahead for the chipmaking giant. Investors will need to closely monitor developments in the market and technological landscape to gauge the future prospects of Nvidia and its position in the rapidly evolving chip industry.