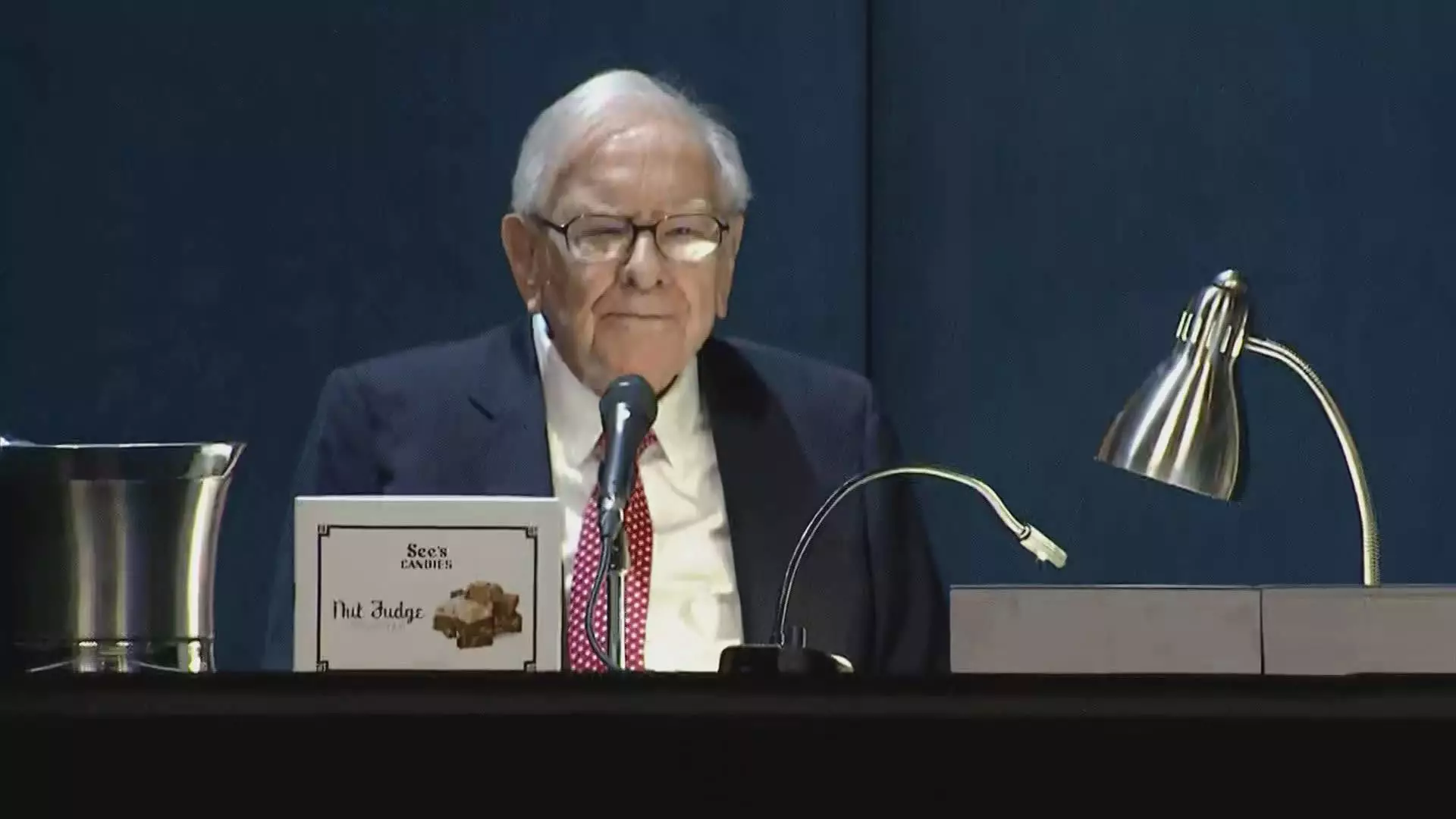

Warren Buffett, the revered investor known as the Oracle of Omaha, has taken significant steps to pare down Berkshire Hathaway’s investment in Apple Inc., a position he has held since 2016. As per the third-quarter earnings report, Berkshire’s Apple stake was valued at $69.9 billion, down nearly 67.2% year-over-year. This marks the fourth consecutive quarter in which Buffett has reduced his holdings in the tech giant, leading to speculation regarding his motivations—and the implications of this trend.

Berkshire Hathaway’s gradual exit from Apple has been noticeable: the conglomerate reportedly offloaded around a quarter of its Apple shares, leaving it with approximately 300 million shares. Analysts have probed into the reasoning behind these mass sell-offs. Initially, speculation surrounded the high valuations of Apple stock. Buffett’s former hesitations surrounding the tech sector make these developments especially intriguing to those who have closely followed his investing philosophy over the decades. Once representing half of Berkshire’s equity portfolio, Apple’s hefty share has been steadily diminished.

One predominant theory surrounding this divestment is tax-related. During the Berkshire annual meeting in May, Buffett hinted that the potential for increased capital gains tax could influence this selling strategy, aiming to mitigate tax impact amidst a growing fiscal deficit in the U.S. However, the sheer scale of the reductions raises questions about whether the decisions are purely tax-centric or involve deeper strategic considerations regarding portfolio management to avoid over-concentration in a single asset.

Berkshire’s Cash Reserves: An Untapped Opportunity?

Furthermore, amidst these stock sales, Berkshire Hathaway has amassed a staggering cash reserve of $325.2 billion, setting a new record for the conglomerate. The idea of pausing buybacks during this quarter arises from concerns about how best to allocate this reserve. While Buffett has historically favored share repurchases or investments during periods of undervaluation, the current strategy leans toward holding cash—precisely when many analysts are anticipating potential investment opportunities in a fluctuating market.

Assessing Apple’s Performance

On juxtaposing these corporate maneuvers with Apple’s stock performance, one can observe a modest 16% increase year-to-date, which is underwhelming compared to the S&P 500’s 20% uptick. While Apple’s loyal customer base and iconic product lines have driven consistent sales, the reduced fervor for tech giants in light of market fluctuations introduces an interesting dynamic. It perhaps reinforces Buffett’s cautious approach as he recalibrates Berkshire’s focus under changing economic conditions.

A Shift in Investment Philosophy?

Buffett’s ongoing divestment from Apple raises several crucial questions about the future direction of Berkshire Hathaway. While historical patterns suggest a willingness to pivot strategically based on market conditions, the scale of the current sell-off could signal a shift in Buffett’s investment philosophy, especially given his traditionally tech-averse stance. Stakeholders will undoubtedly be keenly observing not just what the Oracle of Omaha sells, but what he chooses to buy next, as this could provide invaluable insight into his vision of the next phase of investment strategy.