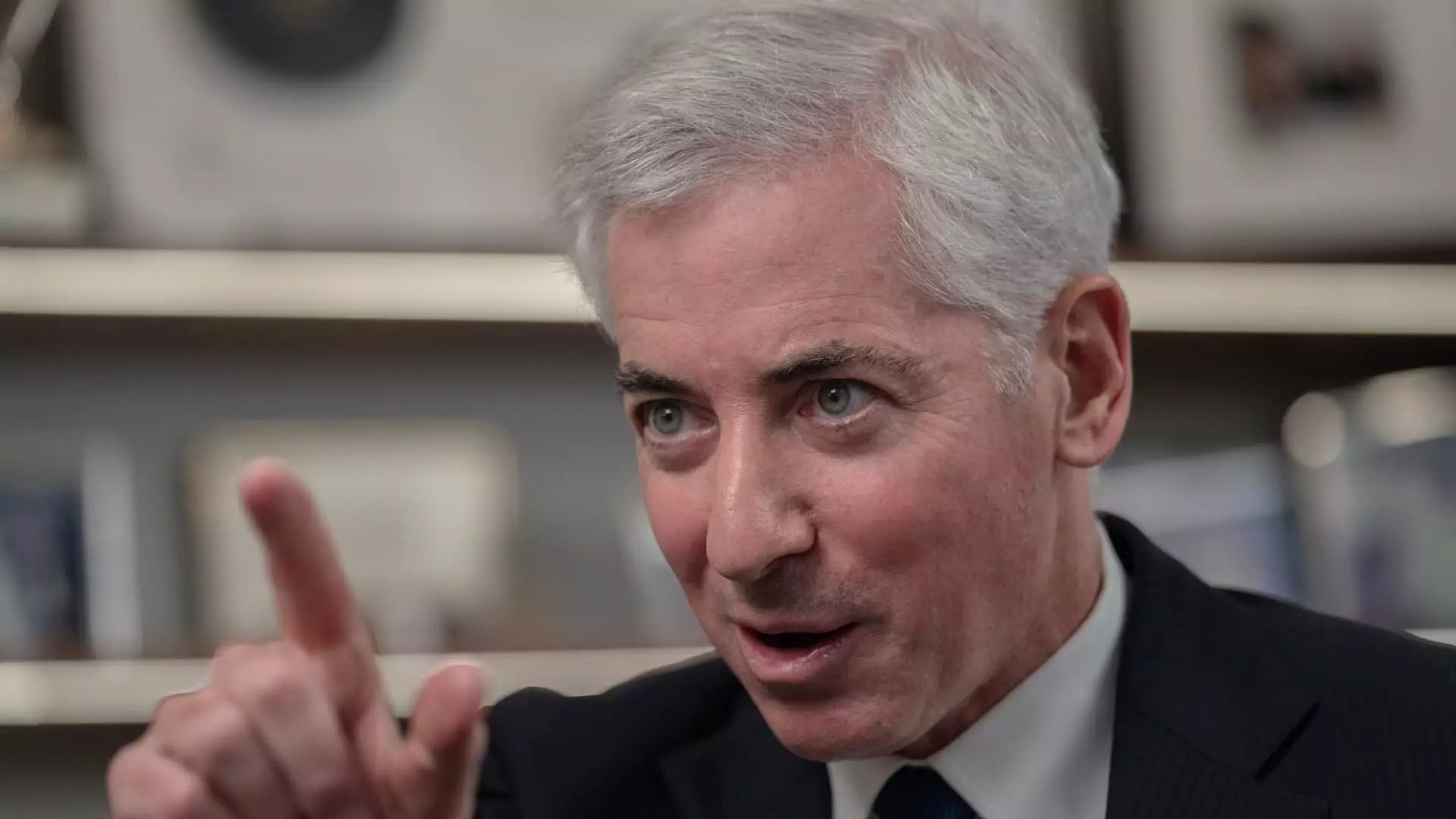

Bill Ackman, the hedge fund titan, has decided to withdraw plans for an initial public offering of Pershing Square USA after investor demand fell short of the original expectations. The fund had initially aimed to raise $25 billion, but was only able to secure interest in the range of $2 billion. This significant difference in investor appetite has led Ackman to reconsider his strategy for the IPO.

Despite the setback, Ackman remains optimistic and has stated that he will be back with a revised plan for the offering. He had envisioned the IPO as a means of modeling Pershing Square after Berkshire Hathaway, but the underwhelming demand has forced him to go back to the drawing board. The decision to withdraw the IPO comes after a notice on the New York Stock Exchange’s website indicated a delay in the process.

Pershing Square currently manages $18.7 billion in assets, with a significant portion of the funds being allocated to Pershing Square Holdings, a closed-end fund that trades in Europe. The failed IPO plan may have an impact on the fund’s overall assets under management, as investor confidence could be shaken by the lackluster response to the offering.

Loss of Investor Interest

Reports have emerged that Baupost Group, a prominent investment firm, opted against participating in the IPO after Ackman had initially indicated that Seth Klarman’s hedge fund would be involved. This loss of investor interest from established firms like Baupost Group could be a blow to Ackman’s reputation and credibility in the market.

Ackman’s decision to publicly list Pershing Square was seen as a strategic move to capitalize on his growing popularity among retail investors. With over one million followers on social media platform X, Ackman has been able to leverage his online presence to shape public opinion on various topics, including the U.S. presidential election and antisemitism. However, the failure of the IPO plan may have a detrimental impact on his relationship with retail investors.