Nvidia CEO Jensen Huang attributes the company’s current advantage in artificial intelligence chips to a strategic bet made over a decade ago. This bet involved significant investment in AI, amounting to billions of dollars, and assembling a team of thousands of engineers. The foresight and commitment to AI has proven to be a defining factor in Nvidia’s success in the market.

Competitive Landscape

One of the key questions posed to Huang during Nvidia’s shareholder meeting was regarding the company’s competition. As traditional chipmakers and startups introduce products to challenge Nvidia’s dominant position in the AI chip market, the company faces increasing pressure to maintain its market share. Despite a drop in Nvidia’s stock value on Wednesday, Huang outlined the company’s strategy to stay ahead of the competition.

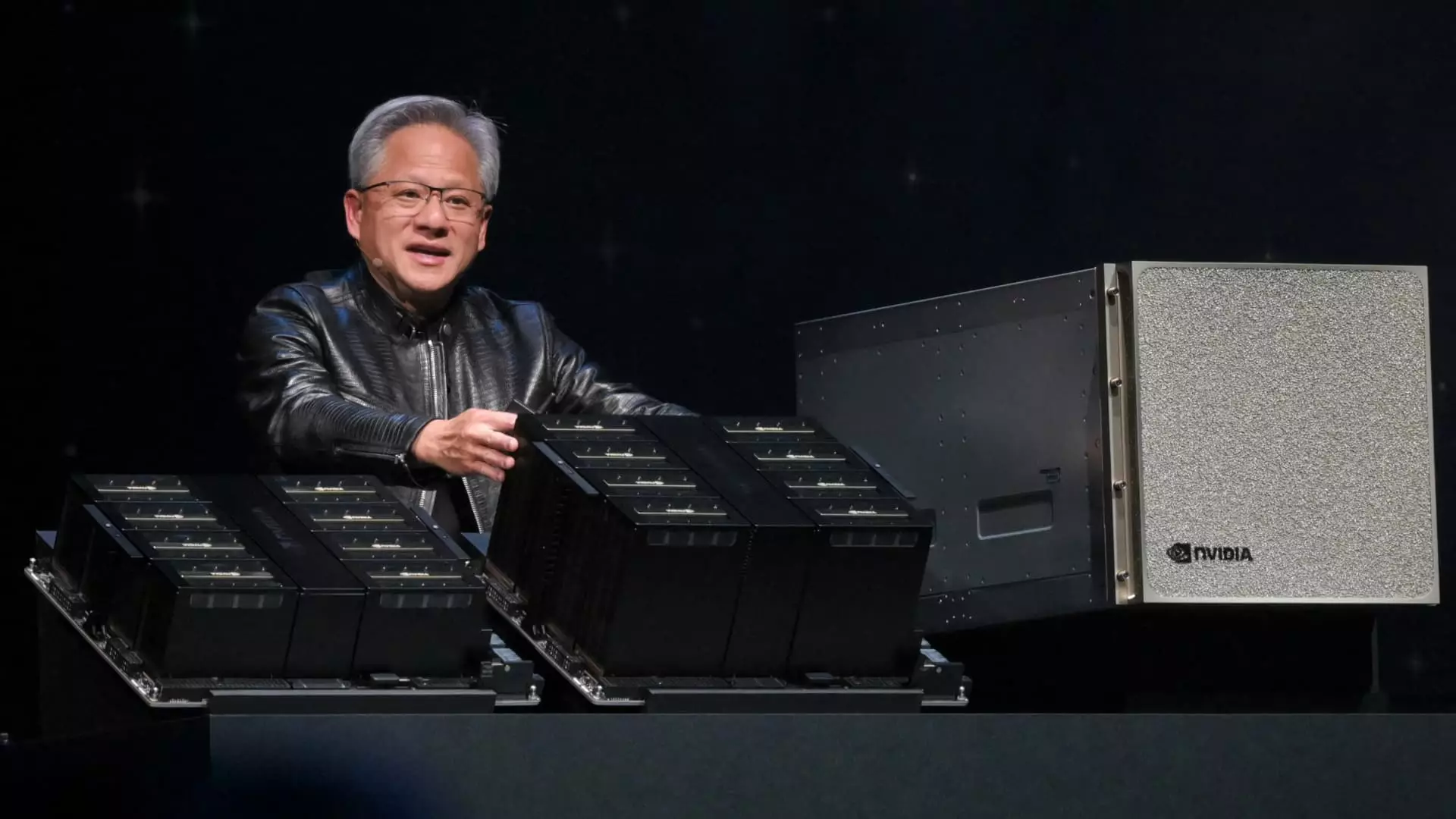

Nvidia has strategically shifted its focus from gaming to becoming a data-center-centric company. In addition to strengthening its foothold in the data center market, Nvidia is exploring new opportunities for AI application, notably in industrial robotics. By collaborating with computer manufacturers and cloud service providers, Nvidia aims to expand the reach of its AI technology and create new markets.

Huang emphasized that Nvidia’s AI chips offer the “lowest total cost of ownership” compared to other alternatives. This claim suggests that while Nvidia’s chips may come at a higher initial cost, their superior performance and efficiency result in cost savings over the long term. By providing value to customers through optimized performance and economic benefits, Nvidia reinforces its position in the market.

Nvidia has established a “virtuous circle,” characterized by a growing user base that drives continuous improvement and innovation. The widespread availability of Nvidia’s platform across major cloud providers and computer manufacturers creates a strong foundation for developers and customers. This, in turn, enhances the value of Nvidia’s platform, creating a cycle of growth and expansion.

Nvidia’s shareholders demonstrated satisfaction with the company’s performance by approving a non-binding vote on executive compensation, referred to as “say on pay.” Executive compensation at Nvidia includes a combination of salary and restricted stock units. Huang’s compensation package, valued at approximately $34 million during the company’s 2024 fiscal year, marked a significant increase from the previous year.

Nvidia’s success in the AI chip market can be attributed to a combination of strategic foresight, continuous innovation, and a focus on delivering value to customers. By staying ahead of the competition, exploring new market opportunities, and fostering a cycle of growth, Nvidia is poised to maintain its leadership in the fast-evolving field of artificial intelligence.