Upon closer inspection of the latest report from Jefferies, it becomes evident that the anticipated expansion of EBIT margins for IT companies in FY25 may not be as promising as initially thought. One of the key factors contributing to this doubt is the concerning trend highlighted in the employee demographics of top IT firms like Tata Consultancy Services (TCS) and Infosys. There has been a noticeable decrease in the share of employees under 30 years old, reaching its lowest point in five years. This shift towards an older workforce, combined with near-peak utilization levels, could indicate a less agile and more costly employee structure. With demand in the industry remaining lukewarm, these firms may encounter difficulties in quickly reversing this trend, potentially impeding margin growth.

Reduction in Subcontracting Costs

Another significant observation made in the report is the substantial reduction in subcontracting costs across the sector. Currently, these costs are at their lowest since FY15, accounting for 9.1% of sales, which marks a 230bps drop from their peak in FY22. This decline reflects the efforts made by IT companies to trim expenses amidst subdued demand. However, with subcontracting costs already minimized, there may be limited opportunities for additional cuts. Although exceptions exist for firms like Infosys and Tech Mahindra, where subcontracting costs remain relatively higher but still near their five-year lows.

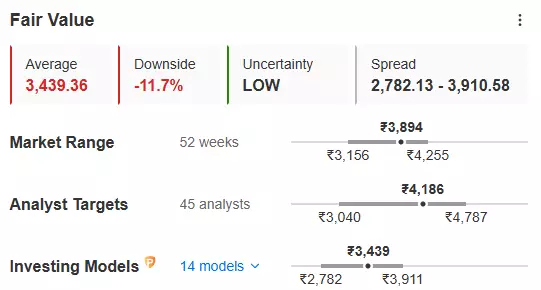

Valuation concerns have also been raised for industry giants like TCS. According to InvestingPro’s fair value assessment, TCS is currently priced at INR 3,439 per share, whereas its market price is at INR 3,893, indicating an overvaluation of 11.7%. This valuation gap poses a risk for investors, suggesting that the stock may be overpriced. Utilizing fair value metrics that adjust with market developments can assist investors in making timely decisions. When a stock’s fair value surpasses its market price, it may be wise for investors to consider taking profits and reallocating their investments to companies with more favorable valuation gaps.

Jefferies’ analysis reinforces the idea that the envisaged margin expansions for IT firms in FY25 may not come to fruition as anticipated. Various factors such as an aging workforce, near-peak utilization rates, and the already minimized subcontracting costs present substantial barriers to margin improvement. Additionally, the valuation concerns raised by InvestingPro, particularly concerning major players like TCS, introduce an additional layer of risk for investors. Keeping abreast of fair value assessments can aid in navigating these challenges and optimizing investment strategies effectively.

The road to margin expansion for IT companies is fraught with obstacles that cannot be ignored. Addressing issues related to employee demographics, subcontracting costs, and valuation gaps is crucial for these firms to sustainably improve their margins and enhance shareholder value. By recognizing these challenges and implementing strategic measures to overcome them, IT companies can position themselves for long-term success in a rapidly evolving industry landscape.