China has recently announced a significant initiative to support consumer purchases through the allocation of 300 billion yuan in special bonds. This fund will be directed towards trade-ins and equipment upgrades, marking a notable expansion of an existing program. According to Ding Wenjie, an investment strategist at China Asset Management Co., the new policy represents a larger commitment in terms of funding allocation and clearly specifies the sources of funds. The central government’s involvement in the program has also been increased, with a ratio of 9:1 between central and local government support, aimed at expediting policy execution.

The scope of the new policy extends beyond traditional consumer goods trade-ins to include areas such as trucks, machinery, home decoration, and smart home appliances. This broader coverage is expected to benefit sectors such as autos, industrials, and home appliances. The policy also includes a doubling of subsidies for new energy and traditional fuel-powered vehicle purchases, providing 20,000 yuan and 15,000 yuan per car, respectively. Moreover, specific subsidies have been outlined for home renovations and the purchase of essential appliances like refrigerators, washing machines, televisions, computers, and air conditioners. Each consumer is eligible to receive subsidies of up to 2,000 yuan for purchases within each category.

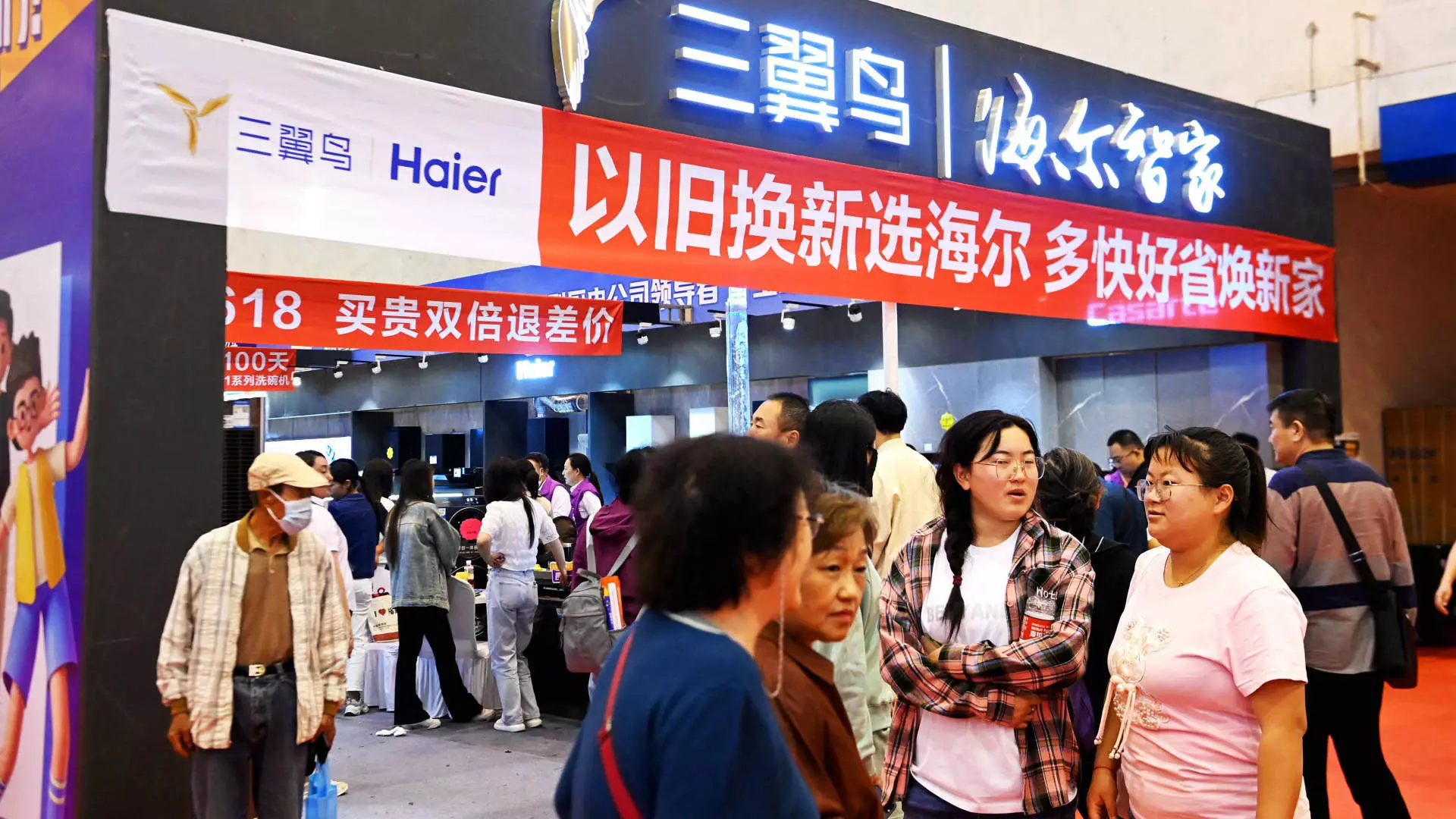

Following the announcement of the new policy, major Chinese home appliance stocks experienced a boost, with companies like Midea, Gree, and Haier registering significant gains. This uptrend in stock performance contrasts with the modest gains seen in broader mainland China indexes. Analysts at Morgan Stanley have expressed optimism regarding the impact of the policy on equipment stocks, citing the historical significance of the 300 billion yuan allocation. In particular, certain stocks are expected to benefit most from the increased subsidies for autos and home appliances.

Despite the sluggish retail sales growth, Chinese authorities have refrained from providing cash handouts to consumers, prioritizing the development of domestic tech capabilities instead. The 300 billion yuan allocation is split between consumer-related trade-ins and business-side equipment upgrades, aiming to stimulate both household consumption and corporate capital expenditure. While the policy is expected to boost consumer spending and corporate investment, its overall impact on GDP growth may be limited due to potential constraints on infrastructure funding.

The consumer-focused measures introduced by China come in the wake of the country’s Third Plenum, a significant event that sets the tone for longer-term economic policy. The government’s emphasis on improving people’s livelihood during development reflects a broader commitment to modernization. Looking ahead, a near-term-focused Politburo meeting is anticipated at the end of the month, signaling the government’s continued efforts to support economic growth and enhance consumer welfare.