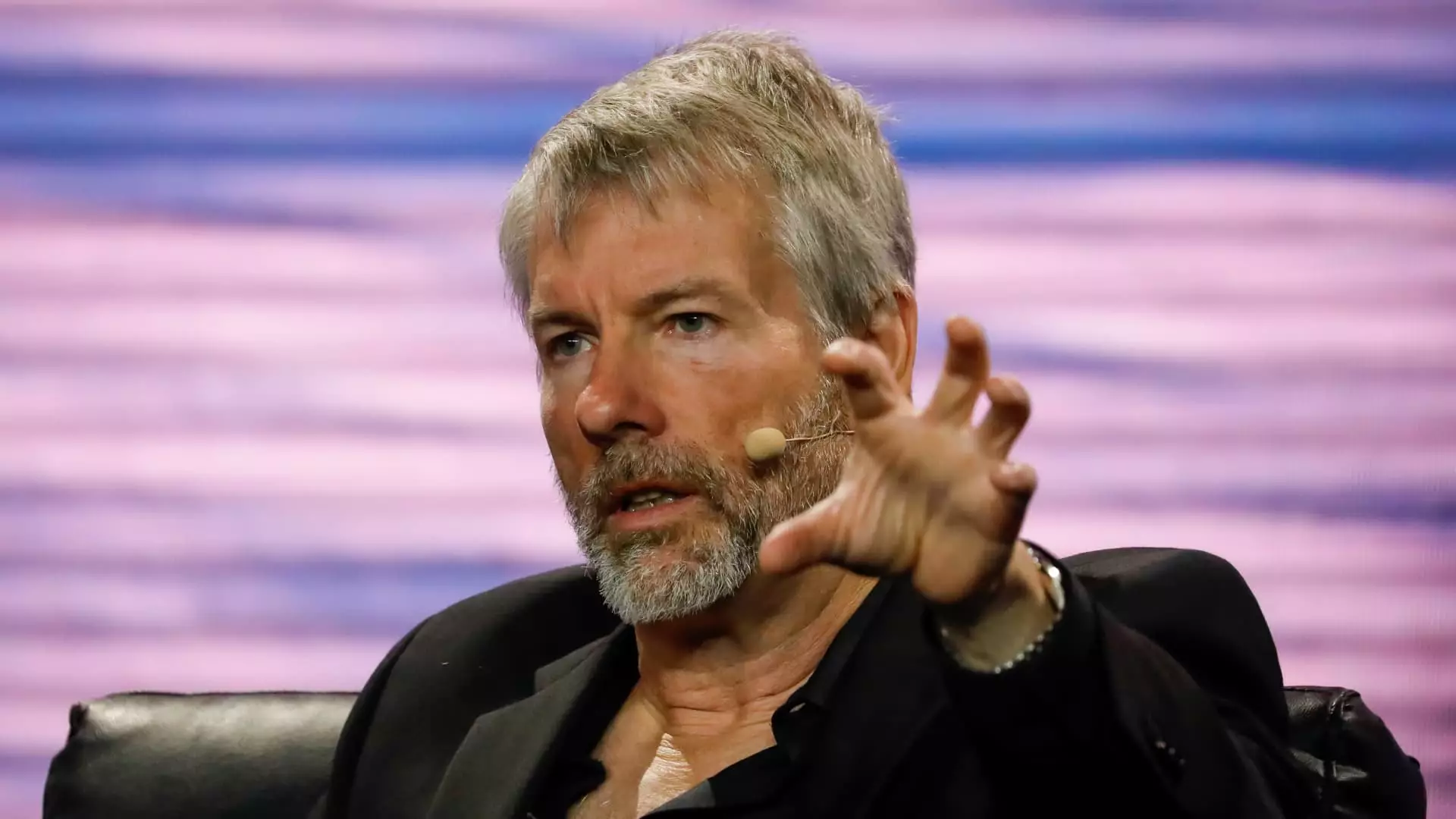

MicroStrategy, under the leadership of CEO Michael Saylor, has been making headlines with its significant Bitcoin purchases. Saylor recently announced on social media the acquisition of 12,000 more bitcoins for $822 million. This move brought MicroStrategy’s total holdings to 205,000 bitcoins, valued at over $15 billion. While this has resulted in a surge in MicroStrategy’s stock value, it raises questions about the company’s reliance on Bitcoin as a proxy.

Following the announcement of the Bitcoin purchase, MicroStrategy’s stock saw significant gains. The stock climbed 11% the day after the purchase, following previous rallies. However, the reliance on Bitcoin as the main driver of the company’s stock value raises concerns about its sustainability in the long run. The volatile nature of cryptocurrencies like Bitcoin can have a significant impact on the company’s stock value.

Strategic Use of Funds

MicroStrategy’s decision to use proceeds from convertible notes and excess cash to purchase Bitcoin raises questions about the company’s strategic use of funds. While investing in alternative assets can diversify the company’s portfolio, the high volatility of cryptocurrencies poses risks. The recent convertible notes offering to fund the Bitcoin purchase may indicate a shift in the company’s financing strategy, moving away from equity funding.

Equity Value Premium Concerns

Canaccord Genuity analysts highlighted the equity value premium of MicroStrategy over its Bitcoin holdings. The analysis showed a significant premium, indicating that the stock value is appreciating at a faster rate than the value of the Bitcoin purchased. This raises concerns about the company’s overreliance on Bitcoin and the potential impact on shareholder value if the cryptocurrency market experiences a downturn.

While Bitcoin has seen impressive gains in recent years, its volatility and regulatory uncertainties make it a risky investment. MicroStrategy’s heavy reliance on Bitcoin as a primary driver of shareholder value raises questions about the company’s long-term sustainability and risk management strategies. Diversification of the company’s investment portfolio and thorough risk assessment are crucial for mitigating potential losses in case of a market downturn.

MicroStrategy’s recent Bitcoin purchase has garnered attention in the market, leading to significant gains in the company’s stock value. However, concerns about the company’s overreliance on Bitcoin as a proxy and the potential impact on shareholder value remain. As the cryptocurrency market continues to evolve, MicroStrategy needs to carefully assess its investment strategies and risk management practices to ensure long-term sustainability and value creation for its shareholders.