The European corporate earnings landscape is currently clouded by uncertainty, especially in light of French political turmoil and trade disputes with China. Investors are cautiously optimistic about second-quarter earnings for companies in the pan-European STOXX 600. However, concerns arise due to the uncertainty surrounding French President Emmanuel Macron’s decision to call for parliamentary elections, as this move has introduced doubts about France’s fiscal discipline and the future direction of the country.

The recent political developments in France have led to a downward trend in European shares, with major indices such as the STOXX 600 and France’s CAC 40 experiencing declines. The market sentiment has shifted as analysts have revised earnings expectations for French companies and tempered their outlook for the broader European equity markets. This political uncertainty has overshadowed the positive economic trends that were previously supporting European stocks.

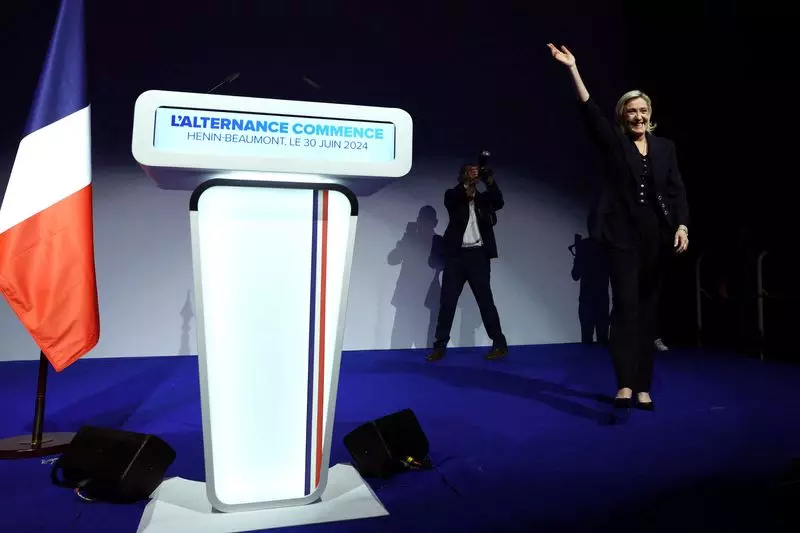

The market reaction to the political developments in France has been mixed, with some investors pulling out of European funds in response to the uncertainty. The rise of far-right and left-wing parties in French parliamentary elections has raised concerns about the stability of the region and the potential impact on labor costs for French firms. Citigroup’s decision to downgrade continental European stocks reflects the market’s sensitivity to political risks and the need for caution in the current environment.

As European companies prepare to release their second-quarter results, investors are looking for reassurance amid the ongoing uncertainty. While many companies have maintained their optimistic outlook for the second half of the year, the market remains cautious due to mixed growth indicators in the euro area. The recent decline in German business morale and concerns about recovery in the region’s largest economy add to the challenges facing European companies.

In addition to domestic political uncertainty, European companies are also facing challenges from escalating trade tensions with China. The proposed EU tariffs on Chinese electric vehicles and Beijing’s retaliatory measures have created a tense trade environment. This trade dispute could have significant implications for Germany, the largest exporting economy in Europe, particularly for sectors such as autos and industrials. The souring relationship between the EU and China adds another layer of uncertainty for European companies to navigate.

Overall, the European corporate earnings landscape is fraught with challenges, as political uncertainty in France and trade disputes with China create a cloud of uncertainty over the market. Investors are bracing for the upcoming results season, hoping for clarity and stability amidst the current turbulence in the European business environment.