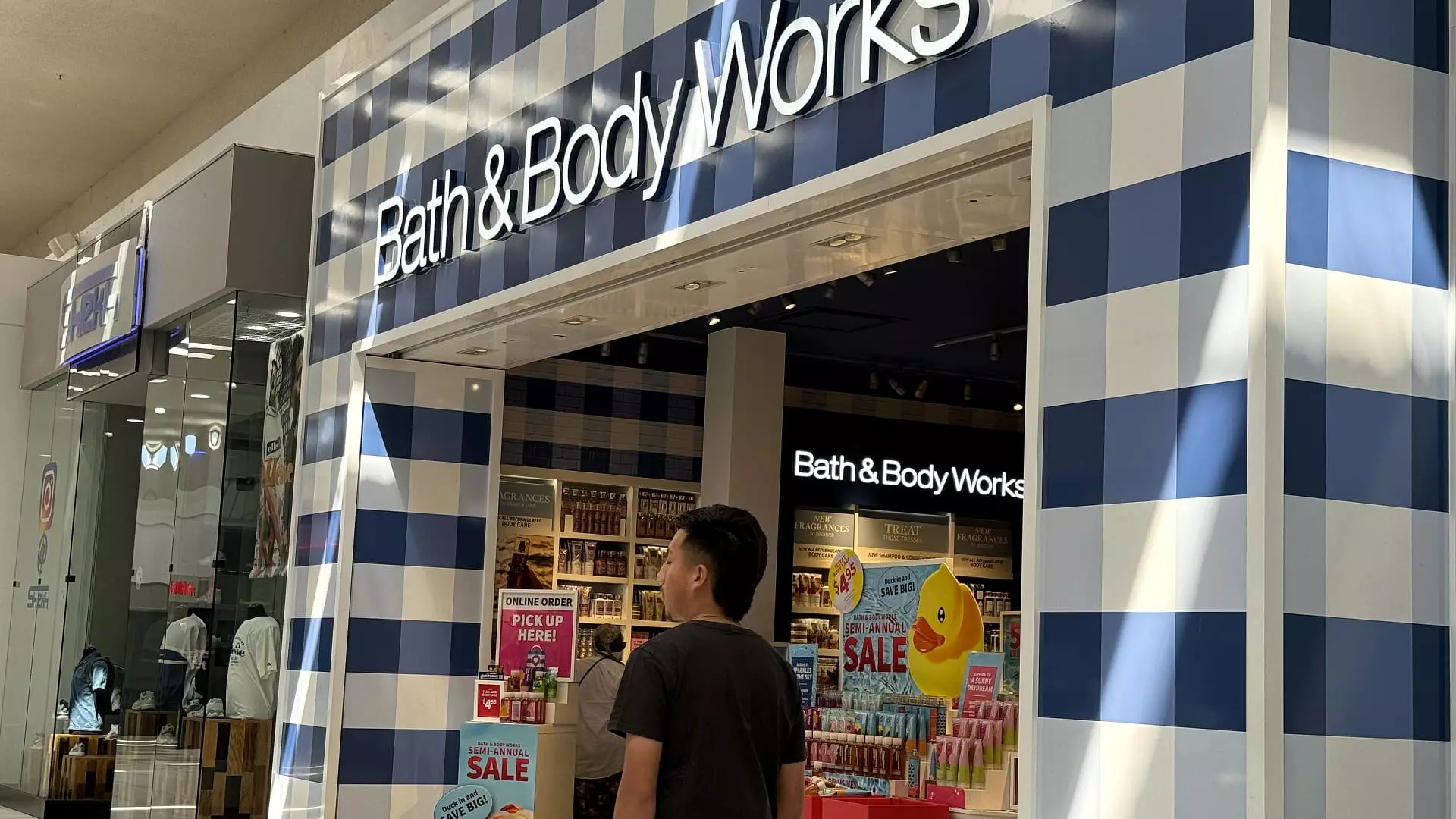

In recent premarket trading sessions, Bath & Body Works has emerged as a significant player following the release of its third-quarter financial results. The company reported earnings of 49 cents per share, surpassing analyst expectations, which estimated earnings of 47 cents. This positive earnings surprise, alongside revenues that reached $1.61 billion—above the anticipated $1.58 billion—led to a remarkable 16% surge in share prices. The strong financial performance suggests that Bath & Body Works has effectively navigated the competitive retail landscape, demonstrating resilience amid broader economic uncertainties.

Robinhood Gains Momentum on Upgrade News

Robinhood, the online brokerage platform known for its commission-free trading, also captured investor attention with a share price increase exceeding 7%. The boost resulted after Morgan Stanley upgraded the stock from an equal weight to an overweight rating. Analysts posit that following the upcoming election period, the company may experience stronger revenue streams due to heightened trading activities in both stocks and cryptocurrencies. This optimism reflects a broader belief in Robinhood’s potential to capitalize on market volatility and regulatory changes, enhancing its appeal to an increasingly active investor base.

Macy’s Faces Setbacks Due to Accounting Irregularities

In contrast to the positive news surrounding other retailers, Macy’s shares took a hit, declining by 3%. The department store chain announced a delay in its third-quarter results after discovering that an employee had made intentional errors in accounting aimed at concealing significant delivery costs. The magnitude of the discrepancies, which ranged from $132 million to $154 million over several years, raised serious concerns among investors. Although Macy’s maintained that these issues did not affect its cash status, the incident underscores the importance of transparency and integrity in financial reporting and has left investors anxiously awaiting clearer operational forecasts.

Abercrombie & Fitch Showcases Promising Outlook

Abercrombie & Fitch’s shares rose by 3% as anticipation builds ahead of its forthcoming quarterly earnings report. Analysts expect solid outcomes, projecting earnings at $2.39 per share, supported by a combined revenue from its Abercrombie and Hollister brands. This rise, totaling over 15% for the month, can be attributed to a bullish sentiment amongst investors following the positive performance of peer retailer Gap, who recently updated its growth projections for the holiday shopping season.

Target’s stock rose nearly 2%, buoyed by Oppenheimer’s assessment that designated it as a top pick. The firm pointed to an attractive risk-to-reward ratio, contrasting the retailer’s current performance, which is down about 12% year-to-date. Target’s dividend yield further enhances its investment appeal, providing a potential safety net for shareholders amidst market fluctuations.

In the tech sector, MicroStrategy’s shares experienced a 3% ramp-up following a bullish forecast from Bernstein, which notably raised its price target for the company. In a similar vein, Sally Beauty Holdings also saw gains of nearly 3% after TD Cowen upgraded its outlook, citing promising free cash flow and favorable valuation metrics as key factors for investor confidence.

Banking Sector Resilience: Santander’s Positive Shift

Lastly, Santander’s stock added 2% after receiving an upgrade from Morgan Stanley, which highlighted the bank’s resilience due to robust capital generation capabilities. Analyst sentiments indicate that despite ongoing economic pressures, Santander is positioned strongly within the financial sector, reinforcing investor trust.

Overall, these movements in premarket trading highlight the dynamic nature of the financial markets, where investor sentiment and analyst insights can swiftly shift stock valuations across a varied spectrum of industries.