In the fast-paced world of stock trading, midday reports can provide valuable insights into market trends and investor sentiment. Several companies have made headlines recently due to significant fluctuations in their share prices, reflecting a mix of investor optimism and challenges. This article delves into the crucial factors driving the movements of these stocks and the implications for investors and industry watchers.

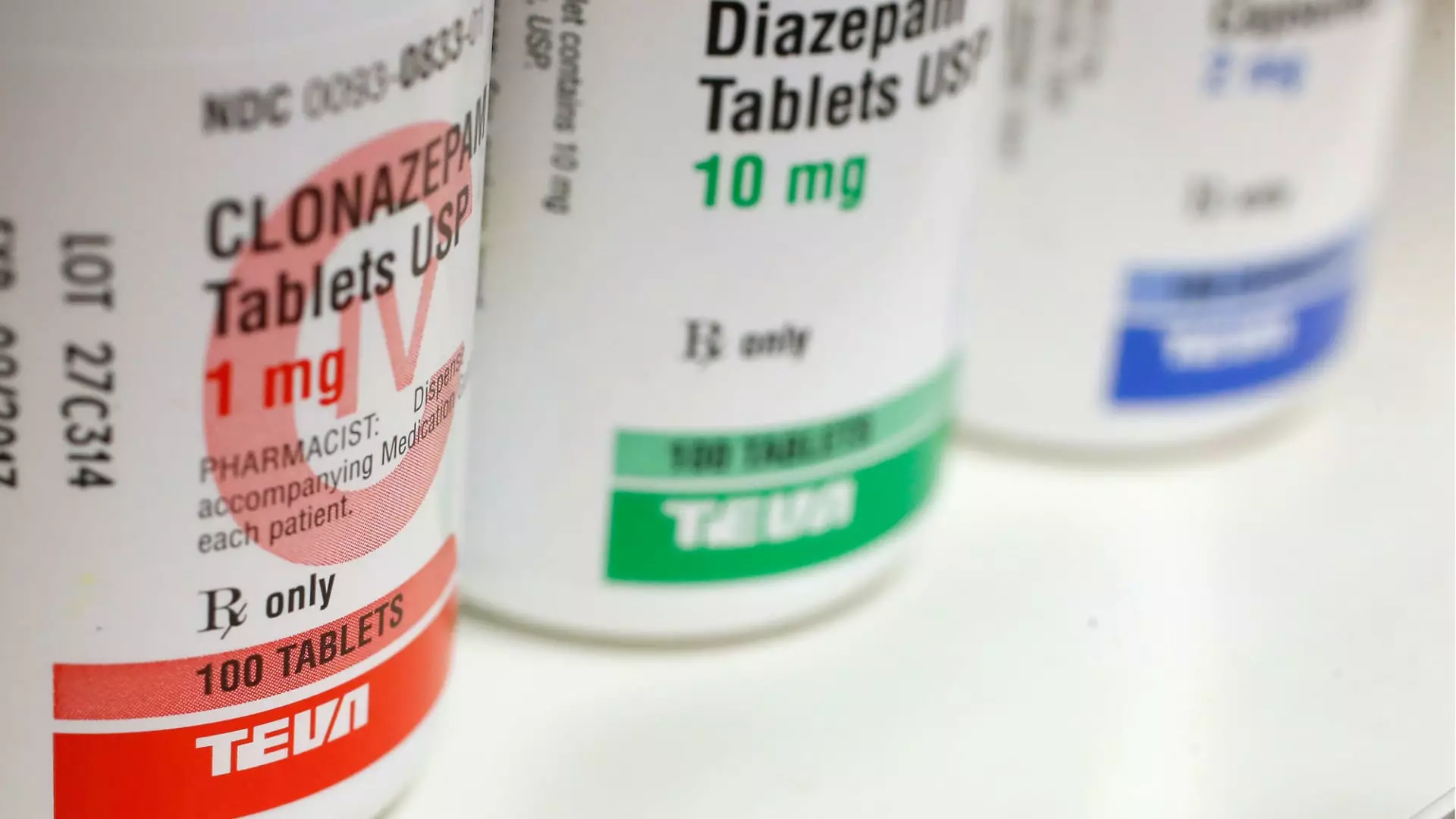

Teva Pharmaceuticals and Sanofi have captured significant attention with their promising Phase 2b trial results for duvakitug, a potential treatment for moderate to severe inflammatory bowel disease. The announcement led to a surge in Teva’s shares, which boosted over 23%, while Sanofi saw a healthy increase of about 6%. This spike underscores the vital role research and development play in the pharmaceutical sector, highlighting how successful clinical trials can translate into tangible market gains. Investors are drawn to companies that exhibit innovation and the potential to address unmet medical needs, which explains the enthusiastic response to these promising trial results.

Consistent Projections from Pfizer

Pfizer, another heavyweight in the pharmaceutical arena, also saw positive movements as its shares climbed about 4%. The company’s expectation of revenue between $61 billion and $64 billion for 2025 aligns closely with Wall Street’s consensus estimate of approximately $63.22 billion. Such consistency in projections is crucial for investor confidence, as it demonstrates reliability and sound management practices within the company. Analysts often react favorably to stable forecasts, leading to positive trading dynamics.

Quantum Computing’s stock soared an astonishing 38%, marking a new 52-week high. This surge followed NASA’s announcement awarding the company a prime contract to utilize its Dirac-3 quantum optimization technology. The rise of quantum computing signifies an influential shift in technology, where companies capable of innovative solutions in data processing and imaging are setting themselves apart. The contract with a prestigious agency like NASA not only validates the company’s technology but also opens doors for future opportunities in various high-tech sectors.

SolarEdge Technologies saw its shares rise by 21% after receiving a double upgrade from Goldman Sachs, reflecting optimism for 2025 as a significant inflection point for the company. The clean energy sector is rapidly evolving, and companies like SolarEdge that show potential for transformational growth are attracting the spotlight. Investor interest in sustainable energy solutions continues to gain momentum, driven by global initiatives aimed at environmental sustainability.

Conversely, drone technology company Red Cat experienced a setback, with its shares falling 12% following a reported fiscal second-quarter loss of 18 cents per share. Though the company had previously surged by 17% due to heightened media attention surrounding drone sightings in New Jersey, the results showcase the volatility often seen in tech stocks, especially in emerging sectors. While the initial excitement may have prompted optimism, the contrast between expectations and actual performance can lead to sharp corrections.

In the technology sector, notable shares like Nvidia and Broadcom have experienced declines of over 1% and nearly 5%, respectively. Nvidia’s recent drop may concern investors as its value slid into correction territory, while Broadcom benefitted from better-than-expected earnings despite its recent decline. Such dual narratives highlight the often unpredictable nature of tech stocks, where stellar earnings can coexist with broader market fluctuations.

Key Developments in Automotive and Sports

Tesla’s stock saw a modest increase of about 1% following an upgrade from Mizuho, spurred by anticipated regulatory changes under President-elect Donald Trump that could favor electric vehicle growth. Meanwhile, Manchester United saw its stock nudged up nearly 2% following UBS’s bullish rating. The potential for improved revenue streams is critical in both sectors as consumers lean into innovation and market performance.

Industry Challenges Reflected in Stock Performance

Lastly, the contrasting performance of companies like Affirm Holdings and Amentum Holdings reveals the challenges many firms face today. Affirm’s stock fell over 3% following an announcement of a convertible note offering, while Amentum slipped 12% after revealing disappointing quarterly results. Such outcomes serve as poignant reminders that even amidst positive market movements, companies must navigate significant operational hurdles that can directly impact investor sentiment.

In sum, the midday trading landscape is a complex tapestry of triumphs and trials. Investors are advised to stay acutely aware of these dynamics, as they reveal much about the shifting tides of market valuation and corporate performance across various sectors.