In a significant move to strengthen the domestic semiconductor supply chain, the U.S. Commerce Department recently finalized a grant package amounting to $406 million for Taiwan’s GlobalWafers. This financial support aims to enhance the production capacity of silicon wafers in the United States and is a cornerstone of the Biden administration’s strategy to reclaim leadership in semiconductor manufacturing. The funds will be allocated to projects in Texas and Missouri, facilitating the establishment of the first high-volume production facilities for 300-mm wafers in the country.

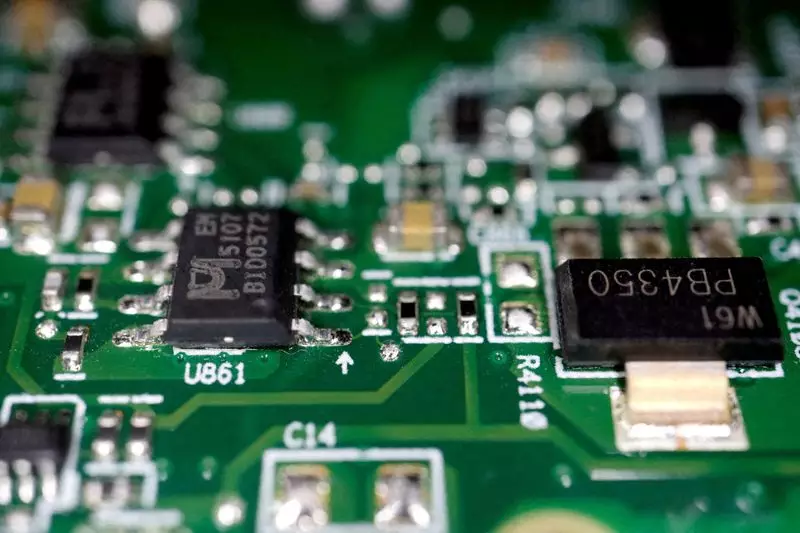

Silicon wafers are pivotal components in the fabrication of advanced semiconductors, essential to a myriad of modern technologies, from smartphones to high-performance computing systems. The production of these wafers is currently dominated by a handful of companies, with significant operations concentrated in East Asia. By bolstering domestic capabilities, the U.S. aims to reduce its dependency on foreign semiconductor supplies and ensure a more resilient technological infrastructure. GlobalWafers, a key player, is set to play a vital role in achieving these objectives and enhancing local manufacturing processes.

The grant will not only support technological advancements but is also expected to generate considerable economic benefits. GlobalWafers has committed to investing nearly $4 billion across both Texas and Missouri, promising the creation of approximately 1,700 construction jobs and 880 manufacturing positions. This job growth is particularly critical in light of post-pandemic economic recovery efforts and the ongoing need for skilled labor in technology sectors.

Previously, GlobalWafers had planned to invest in a facility in Germany but redirected its efforts towards building a $5 billion plant in Texas to produce 300-mm silicon wafers. This strategic shift highlights a growing trend among tech companies to relocate their manufacturing bases closer to major markets, fueled by geopolitical tensions and supply chain uncertainties. Notably, five companies currently dominate over 80% of the global market for silicon wafers, a scenario that underscores the strategic necessity of facilitating U.S. production to mitigate risks associated with supply chain disruptions originating from overseas.

Broader Implications of the CHIPS and Science Act

The funding for GlobalWafers is part of a larger push under the 2022 CHIPS and Science Act, which allocates a staggering $52.7 billion for semiconductor manufacturing and research in the United States. This legislative initiative has catalyzed several significant investment decisions across the industry, including a recent $6.165 billion award to Micron Technology for semiconductor production in New York and Idaho, along with multi-billion dollar subsidies for other industry stalwarts such as Intel and Taiwan Semiconductor Manufacturing Company.

As the U.S. government continues to finalize such substantial awards, it signals a transformative moment in the semiconductor landscape, one that may reshape global production dynamics. The collaboration with GlobalWafers is not just a step towards improved domestic production; it represents a comprehensive approach to reestablishing the U.S. as a formidable player in the global semiconductor arena, a sector pivotal to both economic growth and national security.