In recent years, the proliferation of online scams has become a pressing issue, prompting urgent discussions on accountability and preventive measures. Financial technology companies like Revolut have emerged as champions for consumer protection, advocating for more robust frameworks to address these challenges. As social media platforms play an integral role in facilitating communication and commerce, they also bear responsibility for the safety of their users. In this context, Revolut’s recent critique of Meta, Facebook’s parent company, offers a deeper insight into the inadequacies of current fraud prevention measures.

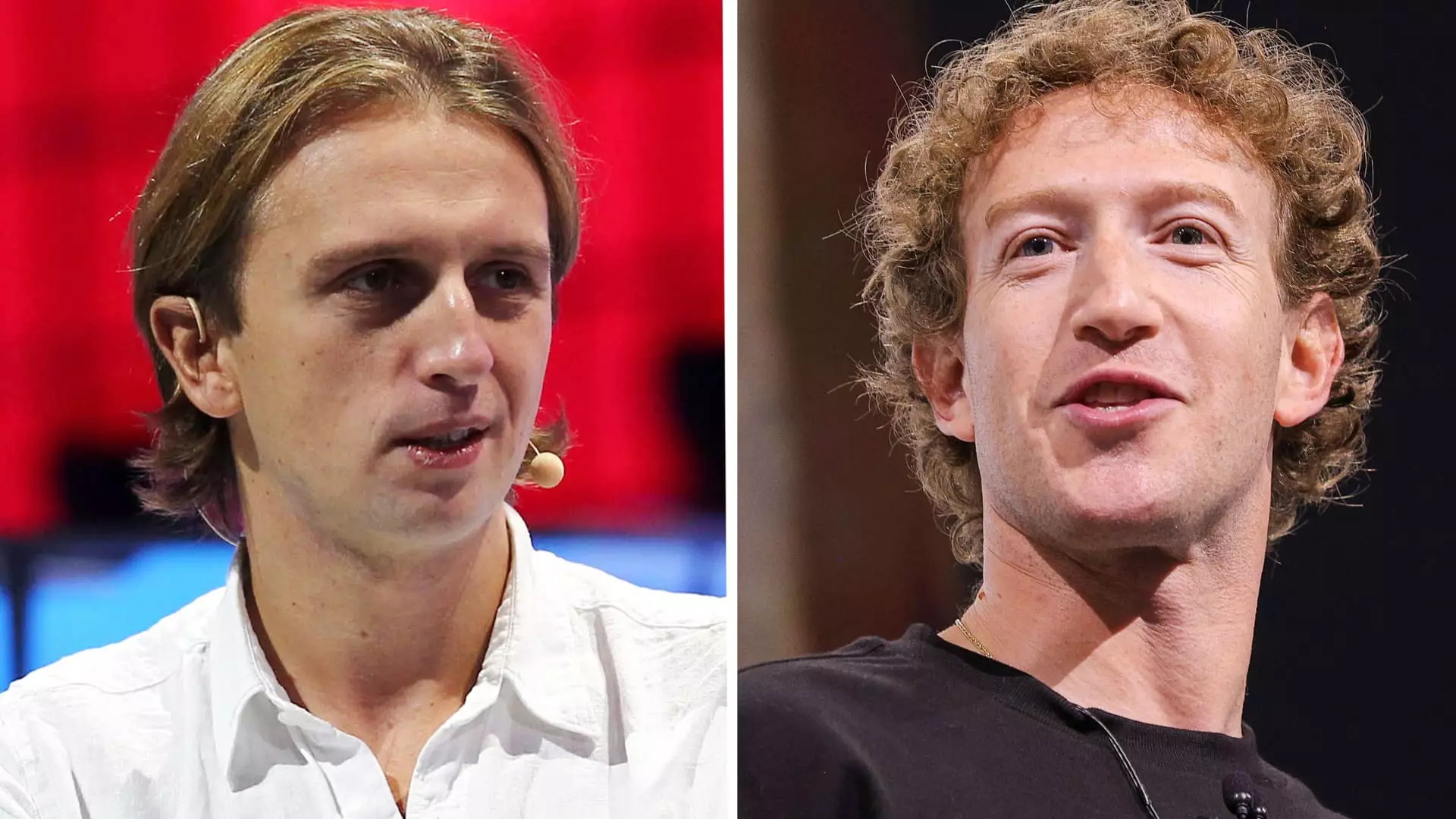

On a momentous Thursday, Revolut made headlines by taking a strong stand against Meta’s newly announced partnership with prominent U.K. banks, NatWest and Metro Bank. The collaboration aims at sharing data to bolster fraud prevention strategies among financial institutions. However, Revolut’s head of financial crime, Woody Malouf, dismissed these efforts as insufficient and described them as mere “baby steps,” emphasizing the need for substantial reforms. This criticism reflects a broader sentiment among fintech companies that social media giants must take greater responsibility for safeguarding their users against fraud.

Malouf’s assertion that “these platforms share no responsibility in reimbursing victims” raises a critical point about the incentives—or lack thereof—for tech companies to invest in consumer protection. A system where platforms are not held accountable could breed an environment where fraud flourishes unchecked, ultimately undermining consumer trust essential for digital commerce.

The U.K. government is implementing payment industry reforms aimed at providing compensation for victims of authorized push payment (APP) fraud. These reforms, coming into effect on October 7, call for banks and payment firms to offer compensation up to £85,000 ($111,000). However, these measures have been criticized for not going far enough, especially after the Payments System Regulator scaled back compensation limits due to pressure from financial institutions. Revolut has been a vocal proponent of more generous compensation amounts, arguing that inadequate reimbursements fail to deter fraudulent activities.

Critically, Malouf’s plea extends beyond government actions to include social media companies’ responsibilities. He advocates for a systemic approach to fraud prevention, emphasizing that platforms like Meta need to implement significant safeguards, including direct compensation for victims. This call for accountability could spark larger conversations across the tech industry about the need for stronger fraud prevention mechanisms and the ethical obligations of companies to protect their user base.

The Path Forward

As Revolut continues to push for change, it raises critical questions that demand attention: How can social media platforms implement effective safeguards against fraudulent activities? What role should these enterprises play in compensating victims? The answers to these complex questions require a collaborative effort between fintech companies, social media platforms, and regulatory bodies.

As fraud continues to evolve, the collaboration between financial institutions and social media platforms is more crucial than ever. Revolut’s bold stance challenges Meta and similar companies to step up and take ownership of their role in fraud prevention. By fostering accountability and encouraging a shared responsibility model, stakeholders can create a safer online environment for consumers, thus promoting trust and security in the digital economy.