The electric vehicle (EV) landscape is often characterized by significant developments and high expectations, particularly surrounding Tesla and its visionary CEO, Elon Musk. However, the recent unveiling of the Cybercab, Tesla’s self-driving robotaxi concept, has left many investors disappointed and questioning the company’s progress. Despite the significant hype leading up to the event, investors reacted negatively, resulting in a notable drop in the company’s stock price following the presentation.

In premarket trading on Friday, Tesla’s shares plummeted by 5.8%, signaling a clear disconnect between the company’s ambitious announcements and investor sentiments. The event, which was keenly anticipated, ultimately missed the mark for many analysts who were looking for concrete milestones and immediate opportunities. The lack of specifics regarding production timelines, manufacturing locations, and technological advancements contributed to this disappointment.

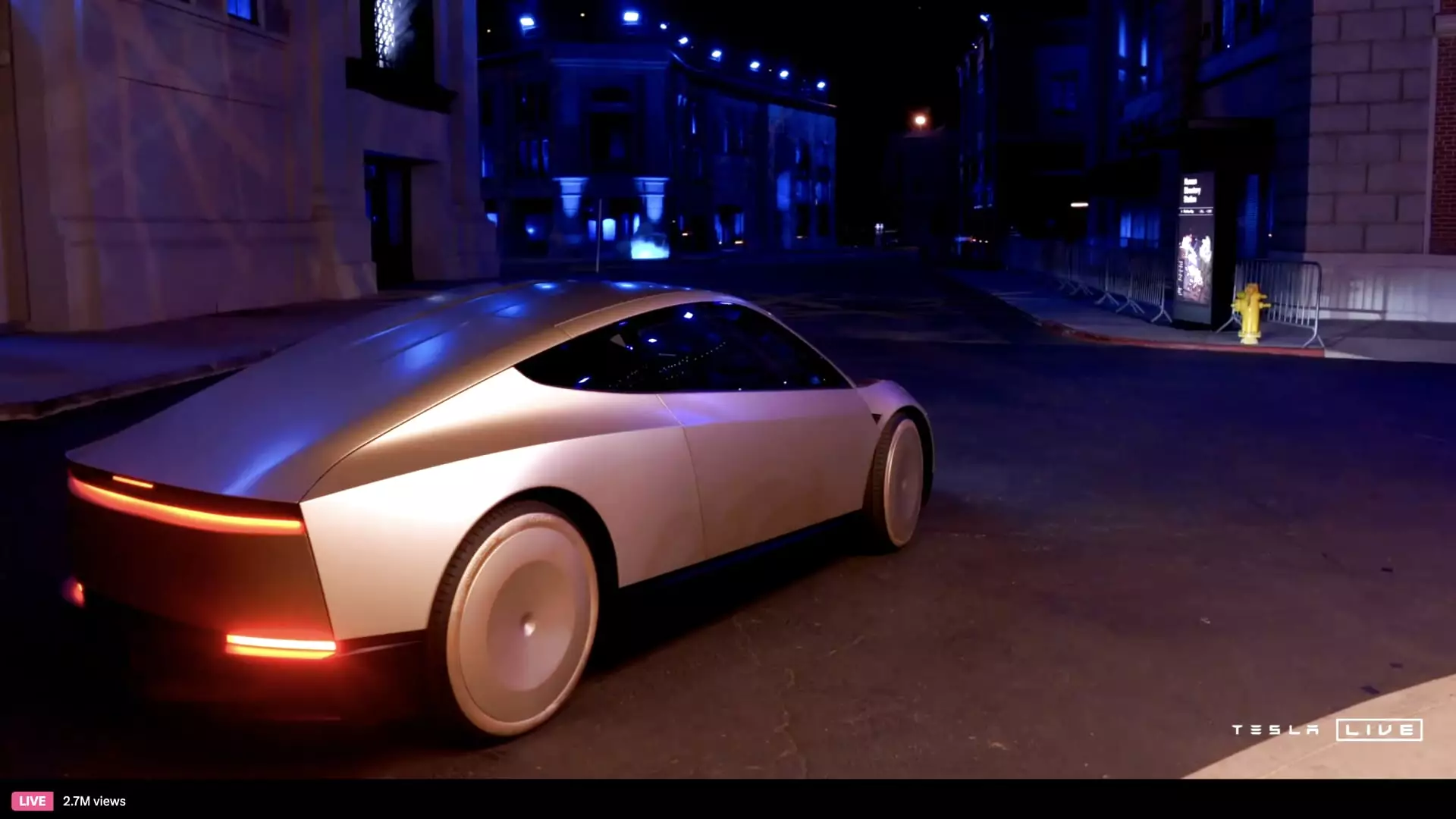

Musk introduced the Cybercab as a futuristic, stream-lined vehicle capable of fully autonomous navigation, devoid of traditional controls such as steering wheels and pedals. While the vehicle’s design certainly aligns with Tesla’s innovative ethos, many investors were hoping for more substantive information on execution and production strategies. As Tesla aims to offer the Cybercab at a competitive price point of under $30,000, skepticism remains regarding the timeline for realization—especially with production not expected until 2027. Such a distant launch date stirs concerns about whether Tesla can maintain its competitive edge in a rapidly evolving EV market, especially if other manufacturers solidify their positions sooner.

Another critical element of the disappointment stems from the minimal advancements disclosed about Tesla’s Full Self-Driving (FSD) technology. Presently available only in a “supervised” mode, which necessitates a human driver to oversee operations, investors were hoping for insights into the anticipated transition to “unsupervised” driving capabilities. Musk suggested ambitions for FSD to be operational in regions such as Texas and California next year, but he offered no significant details on its current status or progress, leaving analysts questioning the viability of such ambitious timelines.

Barclays analysts pointed out that, while the presentation focused heavily on Musk’s grand vision for the future of autonomous vehicles, it glossed over crucial near-term developments. The absence of meaningful updates on FSD, including improvements or empirical data reflecting its evolution, exacerbated investor anxieties. Furthermore, there was no mention of Tesla’s low-cost model projected for production in 1H 2025, which might have been a reassuring signal for investors cautious about the company’s financial trajectory.

Financial analysts from firms such as Piper Sandler and Morgan Stanley expressed their own reservations, indicating that the Community may be skeptical of Tesla’s narrative surrounding AI and autonomous vehicles. Morgan Stanley highlighted a dissonance in Musk’s presentation, asserting that it failed to convincingly establish Tesla’s status as an AI enterprise. This critique reinforces the idea that a cohesive strategy and clear communication of objectives are integral to maintaining investor confidence.

The overall consensus appears to be one of caution and disappointment. Analysts worry that the lack of substantive developments could lead to a continued sell-off in Tesla stock over the coming weeks, particularly as high-frequency trading firms may find the robotaxi launch lacking in immediate value.

With Tesla facing these headwinds, it is essential to contextualize the broader landscape of autonomous vehicle deployment. The journey toward mainstream acceptance for self-driving cars is fraught with hurdles, not only in terms of technological readiness but also regulatory approval. Incidents involving safety incidents have raised legitimate concerns among regulators, further delaying the integration of autonomous vehicles into everyday traffic.

Companies like Waymo, which have successfully launched robotaxi services, serve as reminders of the challenges still at play. Tesla’s ability to establish itself as a leader in this burgeoning market will ultimately depend on its commitment to transparency, innovation, and the tangible realization of its ambitious promises. As it stands, the recent presentation has demonstrated that even audacious visions require the grounding of concrete action—otherwise, they risk becoming mere slogans that fail to propel the company forward.

Stakeholders are left to grapple with the reality that while Tesla remains a torchbearer for electric vehicles, the road ahead for its autonomous technology is still long and winding, filled with obstacles that must be navigated with precision and foresight.