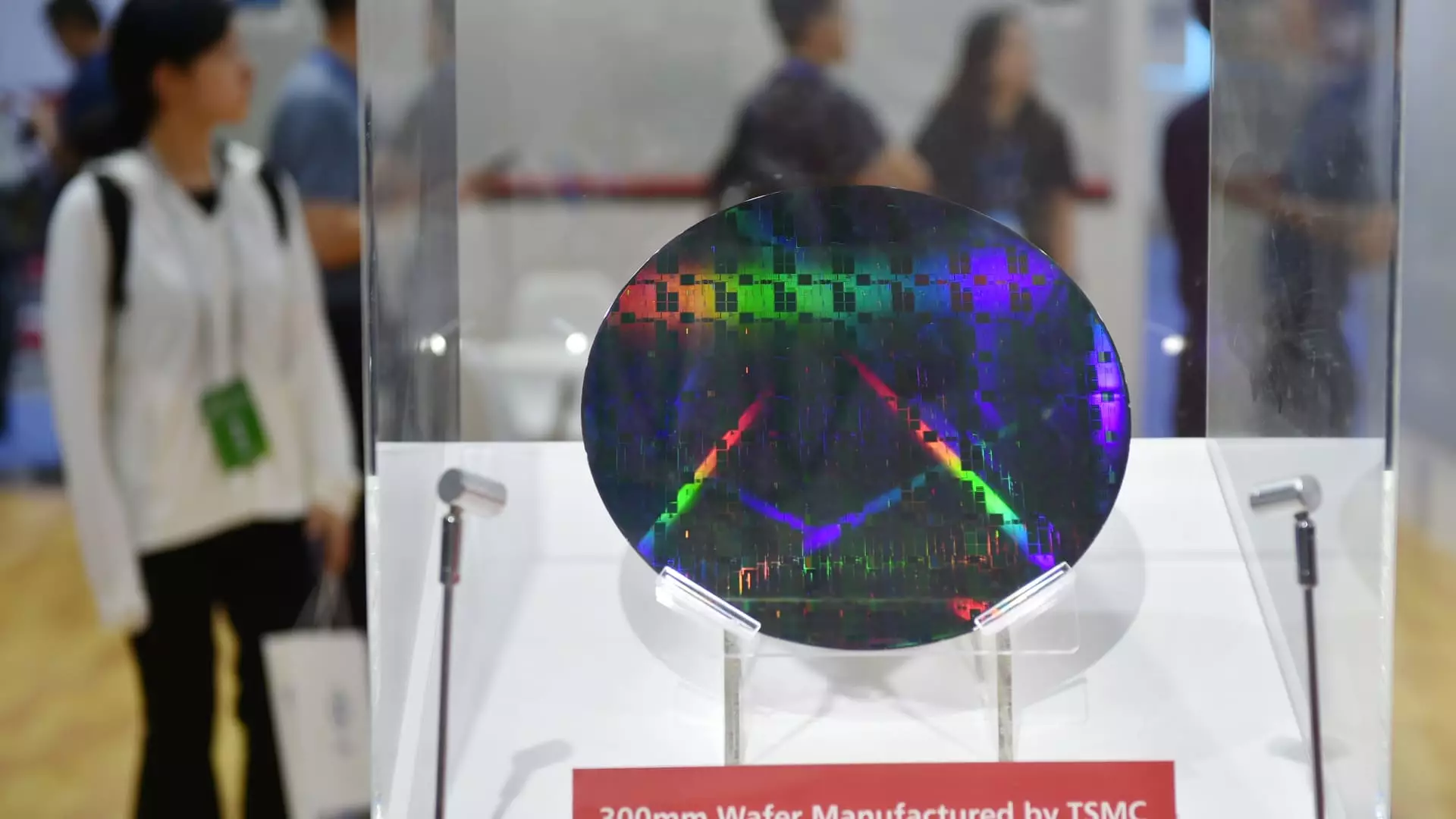

Taiwan has emerged as a key player in the global semiconductor industry, particularly in the realm of AI chip production. The Taiwan Stock Exchange has witnessed significant gains in the past year, largely due to the surge in demand for high-end chips and the server supply chain. Companies like Taiwan Semiconductor Manufacturing Co (TSMC) have been instrumental in driving this growth, producing advanced processors for tech giants such as Apple and Nvidia. TSMC’s role in manufacturing Nvidia’s AI processors has further solidified Taiwan’s position as a vital player in the AI supply chain.

In 2023, Taiwan led the way in advanced chip manufacturing technology, boasting a 68% global capacity share in processes such as 16- or 14-nanometer and more advanced technologies. TrendForce data also revealed that Taiwan held nearly 80% market share in extreme ultraviolet generation processes, which are crucial for producing the world’s most powerful processors. The country’s strong fundamentals in ICT industries have enabled it to leverage the success of technology sectors and drive new economy businesses.

While Taiwan has been a dominant force in the semiconductor industry, it faces growing competition from countries like the United States, South Korea, and China. TSMC’s expansion into other markets, such as Japan, signals a shift in the global chip manufacturing landscape. The U.S. government’s efforts to bolster its domestic chip industry through subsidies and incentives have further intensified the competition. Despite these challenges, Taiwan has demonstrated resilience in the face of adversity, responding quickly to disruptions like natural disasters and geopolitical tensions.

The chief executive of the Taiwan Stock Exchange remains optimistic about the country’s capital markets, citing strong fundamentals, resilience, and rapid response capabilities. While external factors like elections and military conflicts may impact capital markets temporarily, Taiwan’s solid economic foundation and agile business environment are expected to sustain long-term growth. The ability to adapt to changing circumstances and leverage technological advancements will be key to Taiwan’s continued success in the AI chip revolution.