As China’s highly anticipated “Third Plenum” approaches, there are dire predictions for the financial sector. With a focus on constraining financial speculation and a shift towards supporting high-tech and manufacturing, investors are cautiously optimistic. Recent statements from officials, such as Han Wenxiu, reinforce the idea of returning finance to its original purpose of serving the real economy. This shift could potentially lead to subdued growth in the near term as Beijing reevaluates its priorities.

The Third Plenum typically focuses on crucial aspects of China’s long-term economic path. This year, the agenda includes promoting technology self-sufficiency, addressing demographic challenges, and enhancing the social welfare system. By focusing on areas such as employment, income, education, and healthcare, China aims to strengthen its economic foundation for future growth.

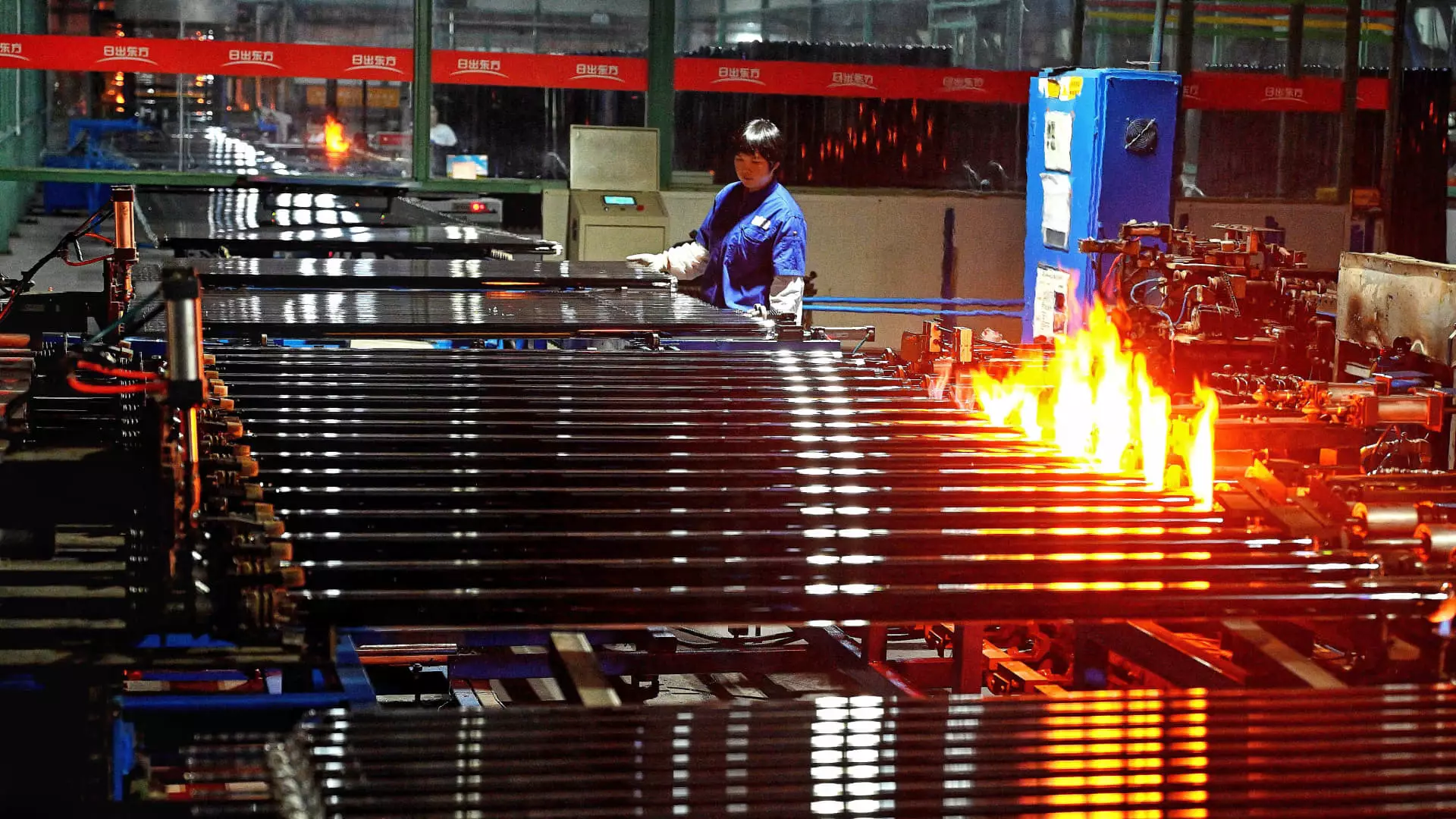

State media often highlight China’s global tech advantages, specifically in areas such as new energy vehicles, lithium batteries, and solar power. Goldman Sachs recently published a report on China’s solar industry, indicating a potential turnaround and calling for industry consolidation. Companies like Daqo New Energy, with a strong balance sheet and market share, are seen as potential winners in the evolving sector.

Goldman analysts have identified opportunities in small-cap Chinese stocks based on R&D intensity, overseas business operations, and alignment with Beijing’s policy goals. Companies like IKD and Autowell, both involved in high-tech manufacturing, are seen as well-positioned for future growth. As China continues to invest in its supply chain and manufacturing capabilities, these companies could benefit from increased productivity and capacity.

While China’s focus on improving productivity and transitioning to a high-income society shows promise, there are also significant challenges and uncertainties along the way. Financial risks, industry consolidation, and global market dynamics all pose potential threats to China’s economic path. Navigating these obstacles will be critical for the country’s long-term success.

The outcomes of the Third Plenum are eagerly awaited as they will provide insights into China’s economic trajectory. By balancing the need for financial sector reform with continued support for high-tech industries, China aims to position itself for sustained growth and prosperity. Investors and analysts will closely monitor the decisions and announcements made during the Plenum, looking for opportunities and risks in China’s evolving economic landscape.