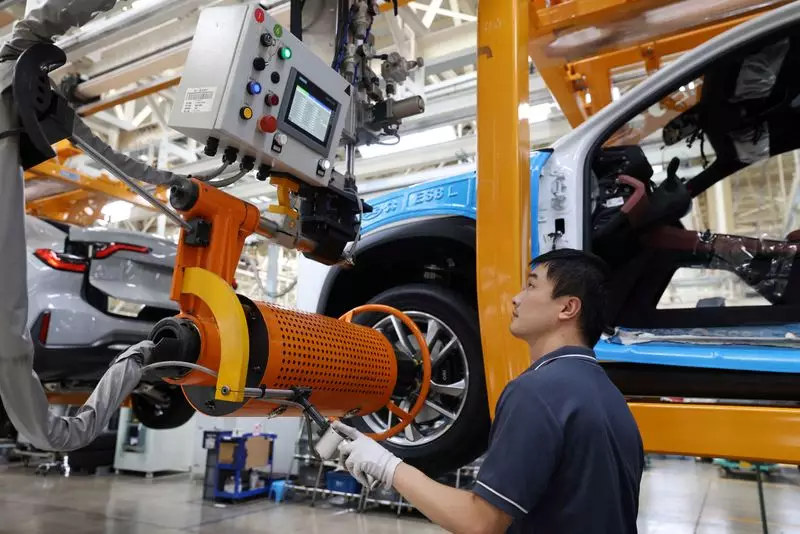

China’s manufacturing sector experienced a significant slowdown in August, reaching a six-month low according to an official factory survey. The official purchasing managers’ index (PMI) declined to 49.1, below the 50-mark that separates growth from contraction. This unexpected decrease raises concerns and highlights the challenges faced by the manufacturing industry in China.

The recent decline in manufacturing activity has led to expectations that policymakers will introduce new stimulus measures. There is a growing sentiment that more support should be directed towards households rather than infrastructure projects. China has signaled a departure from its traditional strategy of investing heavily in infrastructure. Analysts are advocating for a shift towards policies that boost consumer spending to stimulate economic growth.

One of the key areas of focus for policymakers is the revitalization of the consumer market in China. Consumer spending has been adversely impacted by a downturn in the property sector, which has been experiencing a prolonged slump. With a significant portion of household wealth tied to real estate, consumers have been reluctant to increase spending. Efforts to restore confidence in the property market have not yielded the desired results, as evidenced by the sharp decline in new home prices.

The uncertain economic landscape in China has led to varied projections regarding future trends. While there have been some positive indicators, such as retail sales surpassing expectations, there are lingering concerns about the overall economic outlook. Analysts predict further declines in home prices, with a forecasted drop of 8.5% by 2024. This projection points to the challenges that lie ahead for the Chinese economy.

The slowdown in China’s manufacturing sector paints a worrisome picture for the country’s economic growth prospects. As policymakers navigate through these challenges, a strategic shift towards supporting consumer spending and addressing issues in the property market will be crucial. The road to economic recovery will require innovative solutions and targeted interventions to revitalize key sectors and stimulate sustainable growth.