As per Bank of America Securities, investors are advised to consider hedging against the possibility of a significant nonfarm payrolls figure being released later in the week. This report is identified as a key source of potential volatility in the market, with analysts highlighting its importance in the current economic climate. S&P futures have shown decreased sensitivity to CPI data post-Covid, making the nonfarm payrolls report a crucial factor in market movements.

The second print of second quarter U.S. GDP growth exceeded expectations, coming in at a robust 3.0% q/q seasonally adjusted. This growth was primarily driven by strong consumption growth of 2.9%, underscoring the significant contribution of consumer spending to the economy. Despite certain categories experiencing downward revisions, consumer spending remains a vital component, representing nearly 70% of the economy.

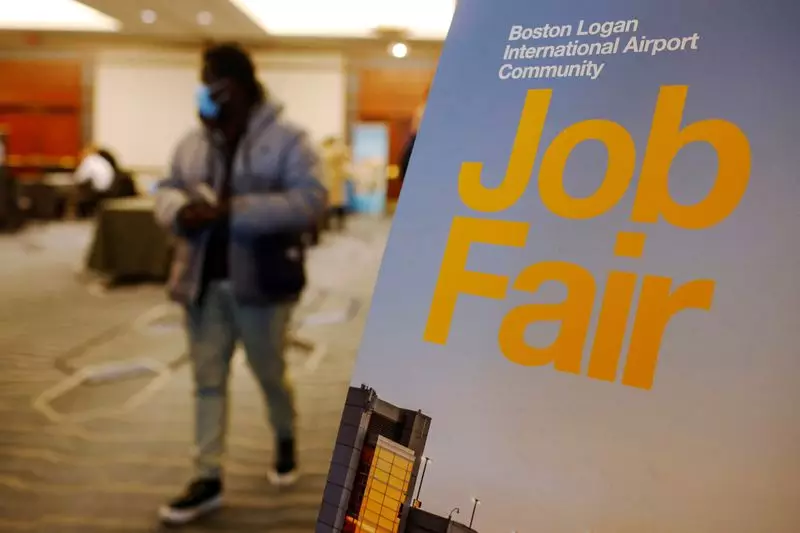

The positive GDP figures have prompted discussions about the overall health of the labor market. A growth rate of 2.9% in spending suggests that the labor market has likely performed well in the second quarter, with strong consumer demand potentially leading to job creation in the future. Bank of America Securities emphasized that the economy has continued to defy skeptics, showing gradual cooling compared to previous years while maintaining steady growth.

Given the current economic landscape and the potential impact of key data releases such as nonfarm payrolls, investors are urged to take proactive measures to hedge against market volatility. Diversifying portfolios, utilizing hedging strategies, and staying informed about economic indicators are essential steps to mitigate risks and protect investments. As uncertainties persist in the market, adopting a cautious approach and considering all potential scenarios are vital for long-term financial stability.

The significance of hedging strategies in light of potential market volatility cannot be understated. With nonfarm payrolls data playing a crucial role in driving market movements, investors must remain vigilant and adaptable to navigate changing economic conditions. By understanding the implications of key economic indicators and taking proactive steps to manage risks, investors can safeguard their portfolios and capitalize on opportunities in the market.