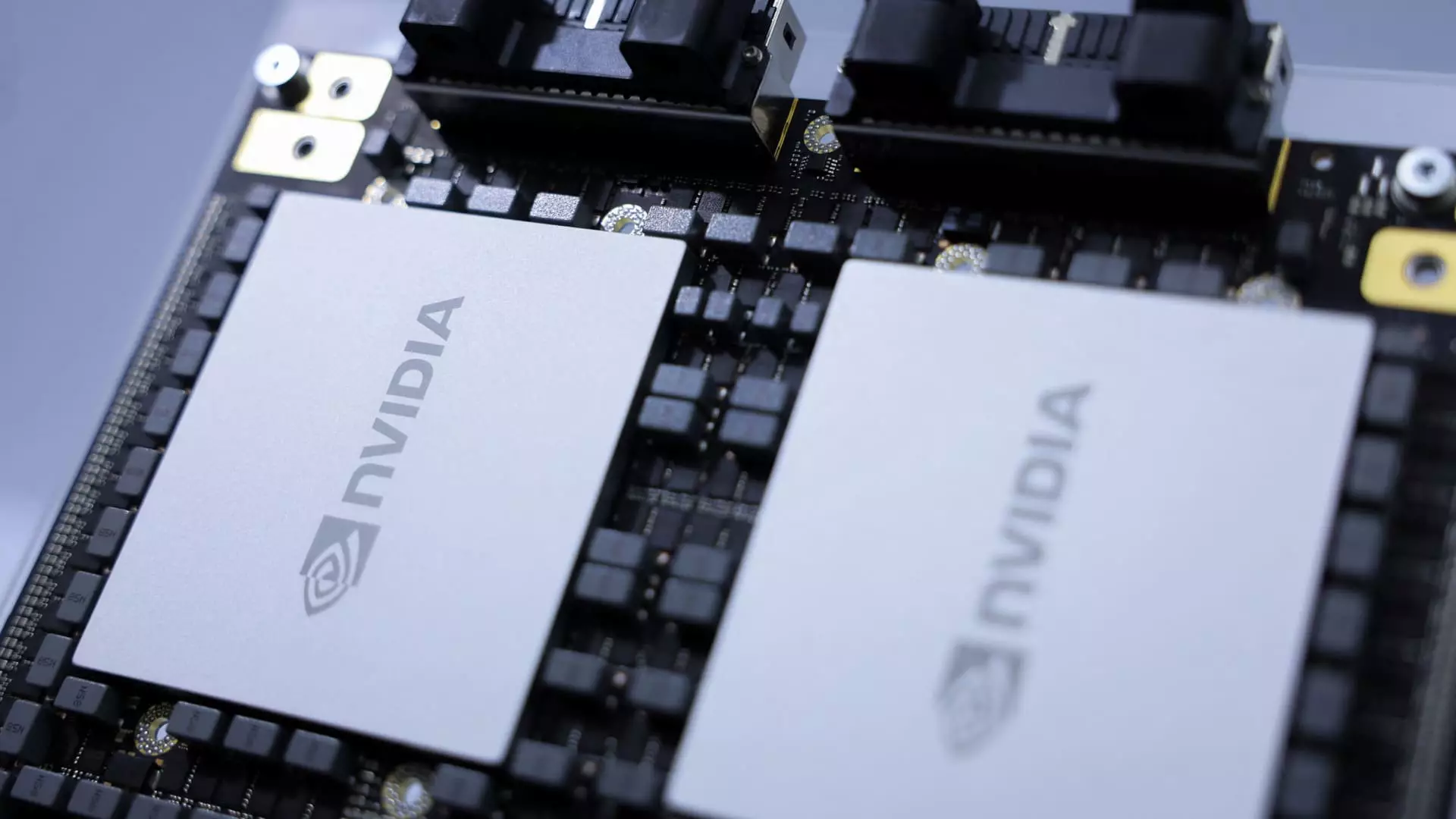

Nvidia, the artificial intelligence darling, saw its shares rise by 1.8% in midday trading following KeyBanc’s price target hike to $180. This increase implies about a 40% upside from the previous day’s close. The firm mentioned that demand for Nvidia’s H100 chip remains robust, even with the upcoming launch of Blackwell in the latter half of the year.

On the flip side, housewares stock Helen of Troy experienced a significant drop of nearly 28% during midday trading, hitting a new 52-week low. The company reported an earnings miss for its first quarter of fiscal year 2025, earning only 99 cents per share, excluding items. Analysts were anticipating earnings of $1.59 per share, resulting in the stock price plummeting. Helen of Troy also revised its full-year guidance downwards.

Software stock UiPath fell by 7% after announcing its plan to reduce about 10% of its global workforce. Most of these reductions are expected to take place by the end of the first quarter in fiscal year 2026. This move is part of a restructuring plan to manage operating expenses effectively.

Conversely, shares of Jumia Technologies surged by 30%, reaching a new 52-week high after Benchmark initiated coverage on the stock with a buy rating. The $14 price target set by Benchmark implies a roughly 65.5% upside from the previous day’s close. The firm believes that the e-commerce platform is at a turning point, emphasizing a demographic shift in the region and Jumia’s position as a leading pan-African provider with tailored services to capture demand effectively.

Chemical company Chemours experienced a 2% jump in its stock price after receiving an upgrade to buy from neutral at UBS. The firm foresees significant potential for outperformance due to favorable demand and price drivers expected in the coming years.

Unfortunately, U.S.-listed shares of the oil and gas giant BP dropped by 4.5% after the company issued a warning stating that it anticipates posting an impairment of up to $2 billion in the second quarter. BP also expects weak refining margins, which will likely have a negative impact on its earnings results.

The electric vehicle company Lucid witnessed a nearly 1% increase in its stock price after soaring about 8% in the last trading session. The spike in Lucid’s stock came after the company announced that it had delivered 2,394 vehicles in the second quarter, representing a 70% year-over-year increase.

Healthcare stock Novo Nordisk saw a decline of around 1.7% following the publication of a study in JAMA Internal Medicine. The study found that tirzepatide, the active ingredient in Eli Lilly’s Mounjaro and Zepbound, is more effective for weight loss than semaglutide, the active ingredient in Novo Nordisk’s Ozempic and Wegovy.

Shares of Sony surged by close to 4% after the parent company of Paramount Global, National Amusements, and Skydance Media agreed to a merger. This merger reportedly attracted a bid from Sony and Apollo, according to CNBC reports.

On a positive note, shares of the electric vehicle company Tesla jumped by more than 4%. Morgan Stanley maintained its overweight rating on Tesla, highlighting that the company’s share of the global battery electric vehicle market reached 15% in May. Tesla is on track for its 10th consecutive positive trading day.

Finally, Corning, the maker of specialty glass, experienced nearly a 4% increase in its stock price. The day before, the company raised its expectations for second-quarter core sales to about $3.6 billion, up from its previous forecast of approximately $3.4 billion. Additionally, Corning expects core earnings per share to be at the high end or slightly above management’s guidance of 42 cents to 46 cents.