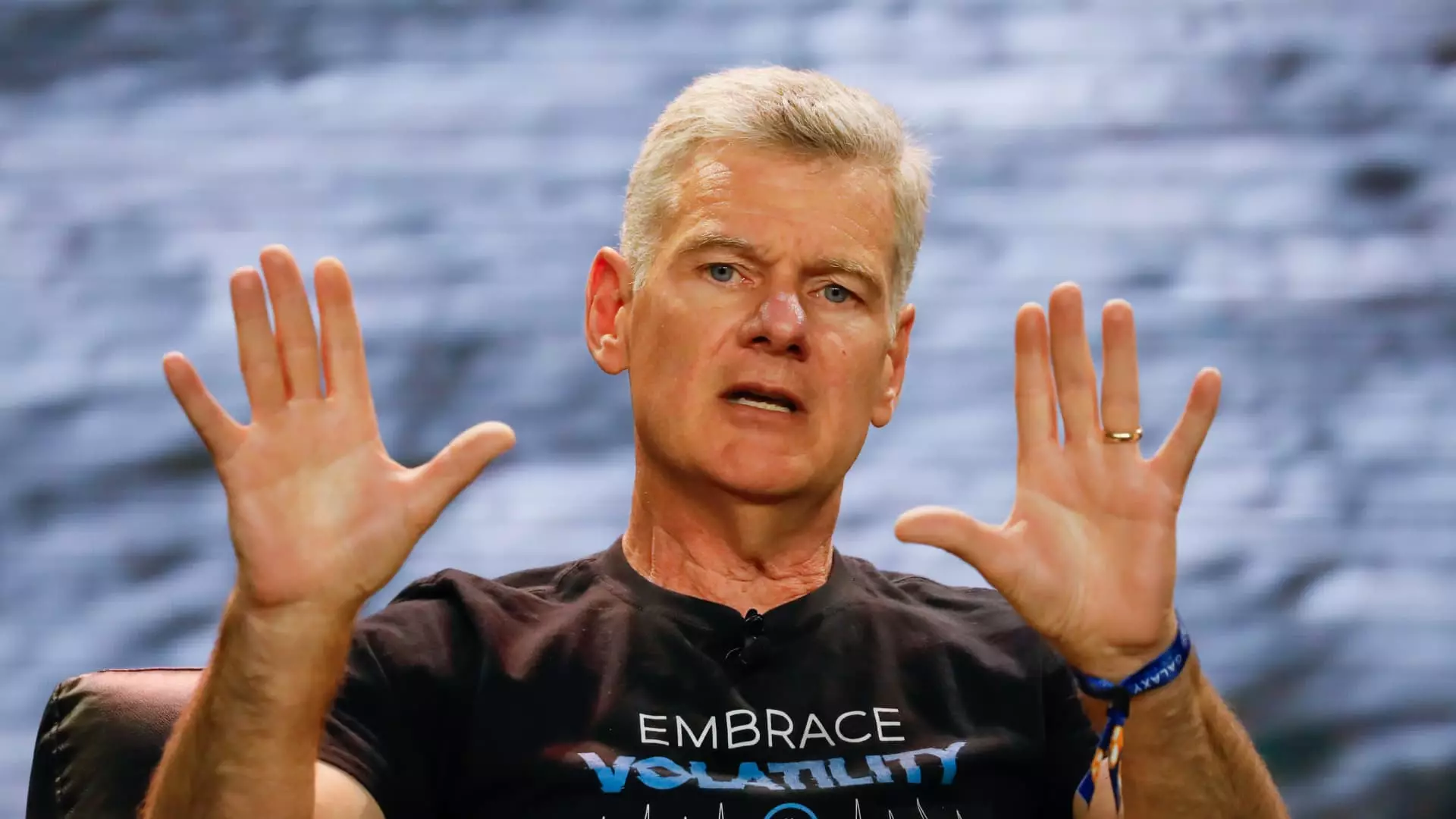

Hedge fund manager Mark Yusko has made a bold prediction regarding the price of bitcoin, stating that he believes it will more than double this year to reach $150,000. In a recent interview on CNBC’s “Fast Money,” Yusko urged investors to “get off zero” and consider allocating between 1% to 3% of their portfolios to bitcoin. According to Yusko, bitcoin is the reigning king in the world of cryptocurrencies and serves as a superior alternative to gold. With bitcoin currently trading at around $70,700, Yusko sees the potential for significant growth in the coming years.

Factors Driving Bitcoin’s Growth

Yusko attributes the bullish outlook for bitcoin to a number of key factors. He highlights the recent launch of bitcoin exchange-traded funds (ETFs) in January as a major driver of growth for the cryptocurrency. Additionally, Yusko points to the upcoming bitcoin halving event, which is expected to create a supply shock in the market. The halving, which occurs approximately every four years, reduces the rate at which new bitcoins are created, leading to scarcity and potentially driving up the price. Yusko anticipates that the post-halving period will see a surge in bitcoin prices, with historical trends indicating that peak prices typically occur around nine months after the event.

Coinbase and the Future of Cryptocurrency

In addition to his bullish stance on bitcoin, Yusko’s firm has invested in crypto online trading platform Coinbase. Yusko expressed optimism about the future of Coinbase, noting that the company is positioned for significant growth. Shares of Coinbase have soared by almost 321% over the past year, reflecting the growing interest and adoption of cryptocurrencies among investors.

Overall, Yusko’s predictions and forecasts paint a rosy picture for the future of bitcoin and the wider cryptocurrency market. While the volatile nature of cryptocurrencies means that prices can fluctuate rapidly, Yusko remains confident in the long-term potential of bitcoin as a valuable asset class. As investors worldwide continue to embrace digital currencies, the stage is set for bitcoin to potentially reach new heights in the coming years.